MARKET INSIGHT POST

Q4-2022 Minneapolis-St. Paul Office Market Update

Forte Principal, Jim Jetland, lends insight to the Twin Cities office market report recently released by MNCAR/REDI.

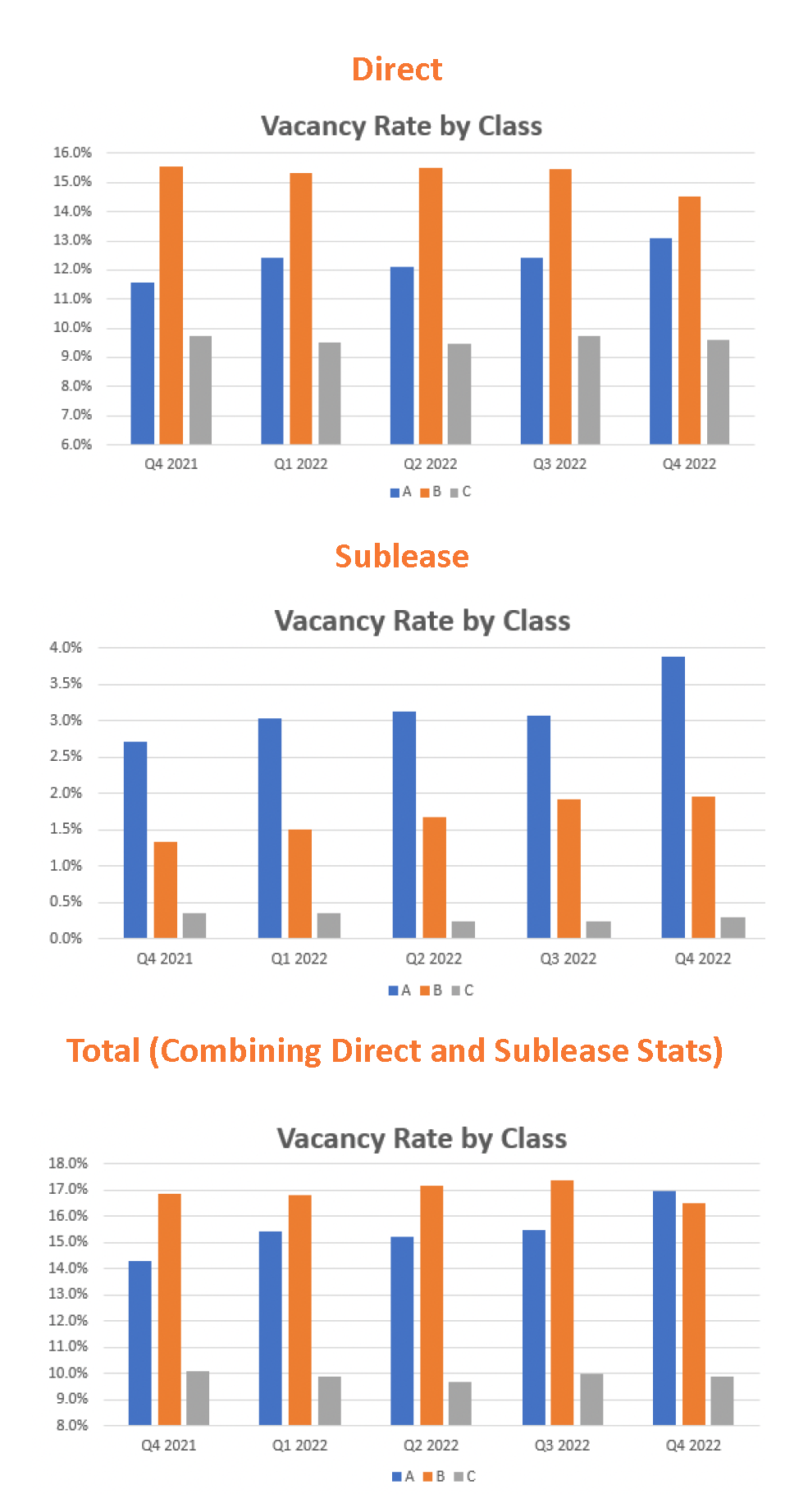

The Twin Cities office market continues to be challenged due to a few factors, but the most impactful factor is the work from home concept. While more workers are finding their way back into the office more frequently, many companies have excess space which is demonstrated by the increase of sublease space from 3.7M square feet to 4.5M square feet, adding to the available inventory. As leases expire, it is expected that many companies will attempt to reduce their existing office footprint, which will continue the trend of increased vacancy.

Not all news is bleak in the office market, as some buildings have benefitted from the concept of a “flight to quality”. More tenants are concerned with locating to higher quality buildings with better locations and more amenities. One trend being played out is when companies relocate, they commit to less space but in a more expensive, higher quality building with hopes of luring more employees back to the office.

Q4-2022 Office Market Update

ECONOMIC OVERVIEW:

MARKET OVERVIEW:

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET HIGHLIGHTS:

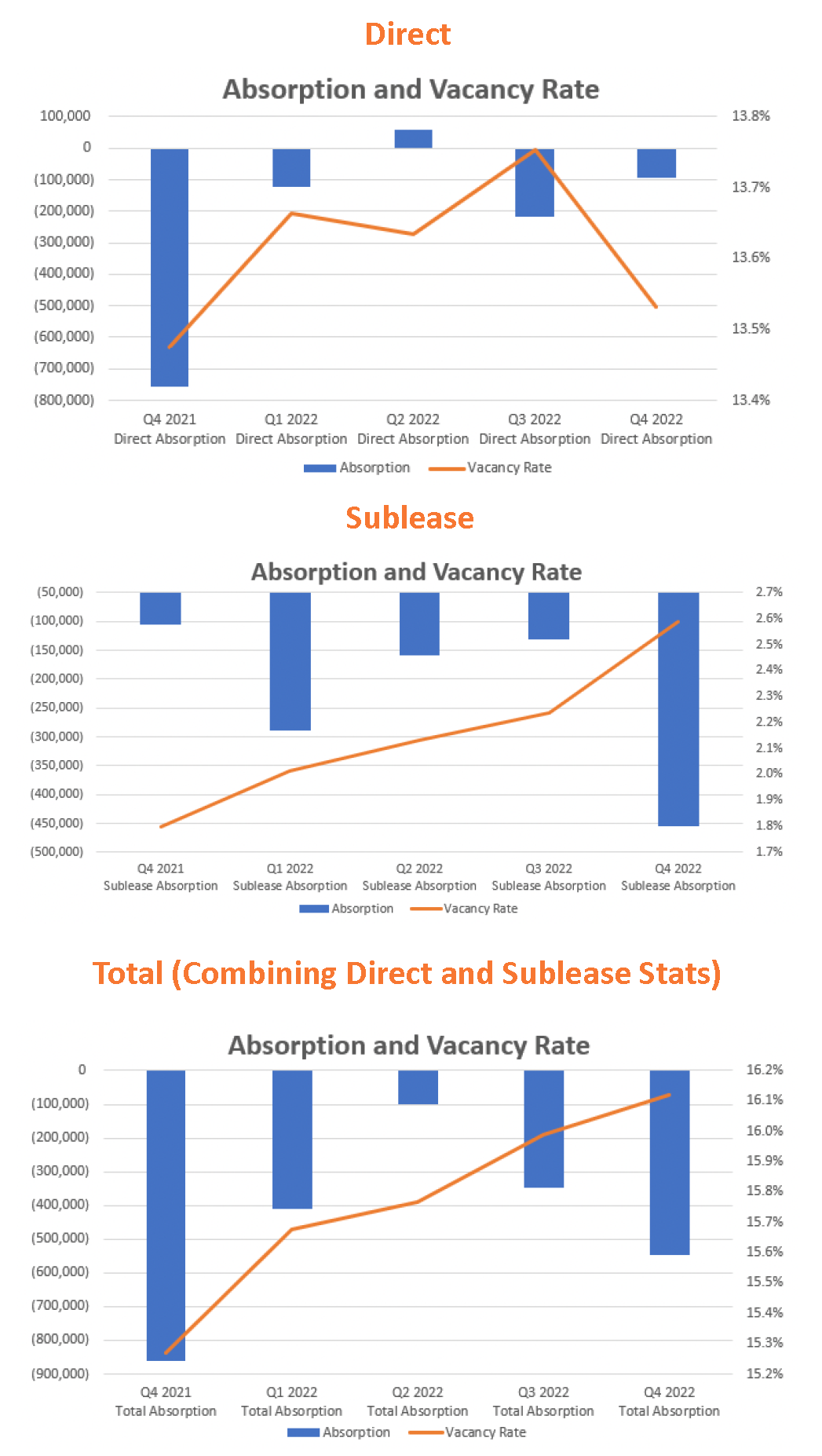

ABSORPTION & VACANCY RATE

(Multi and Single Tenant)

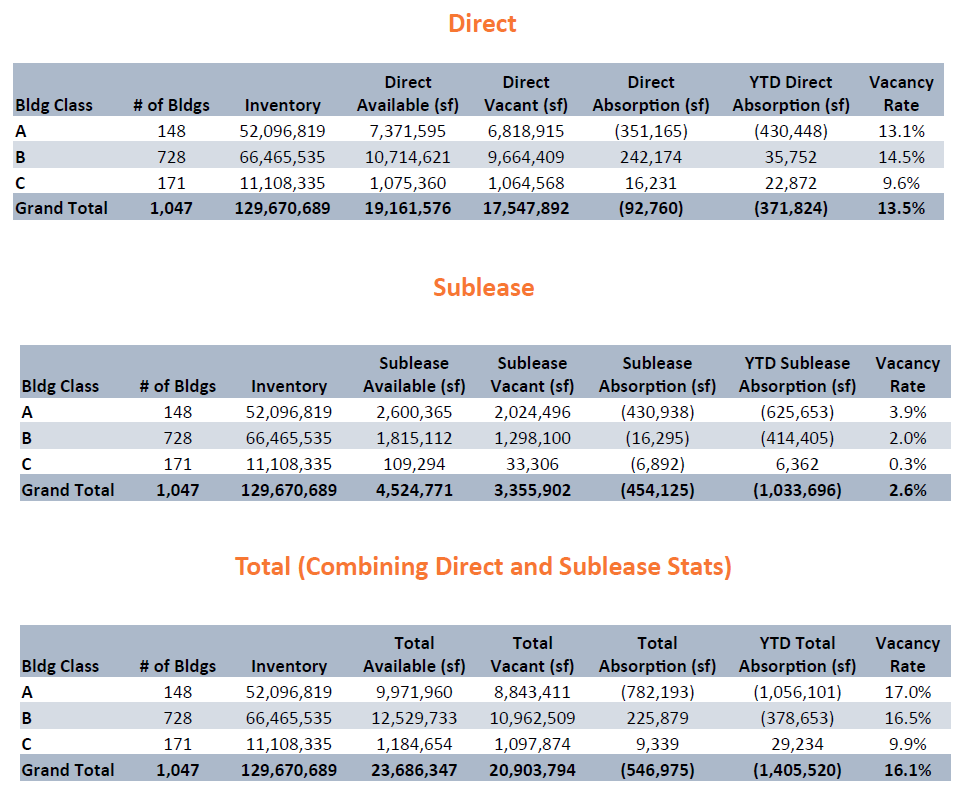

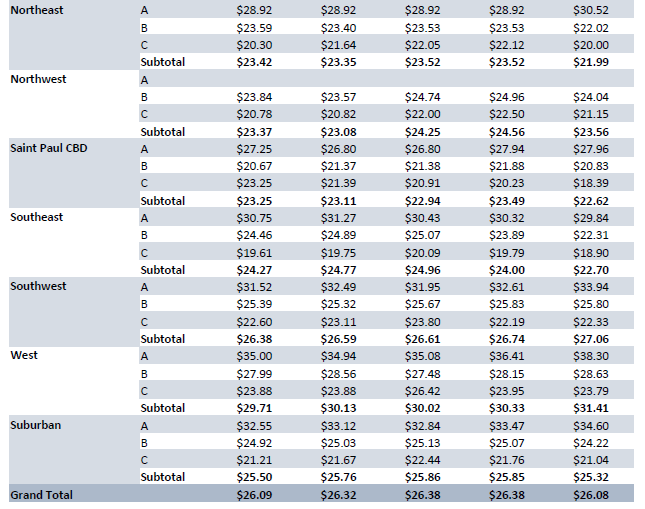

MARKET STATISTICS BY BUILDING CLASS

(Multi and Single Tenant)

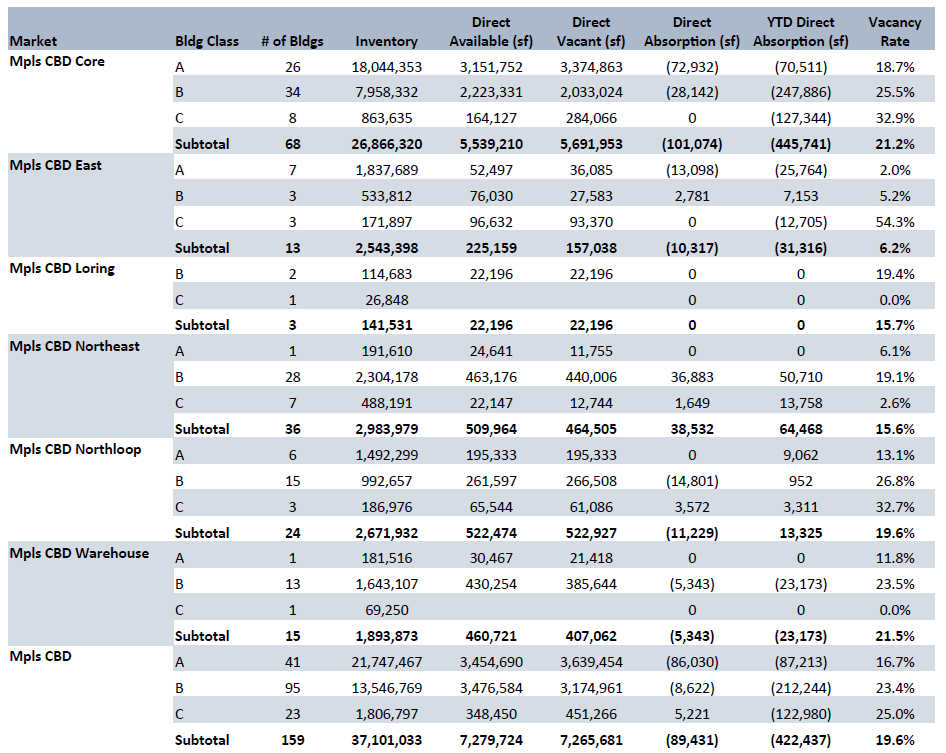

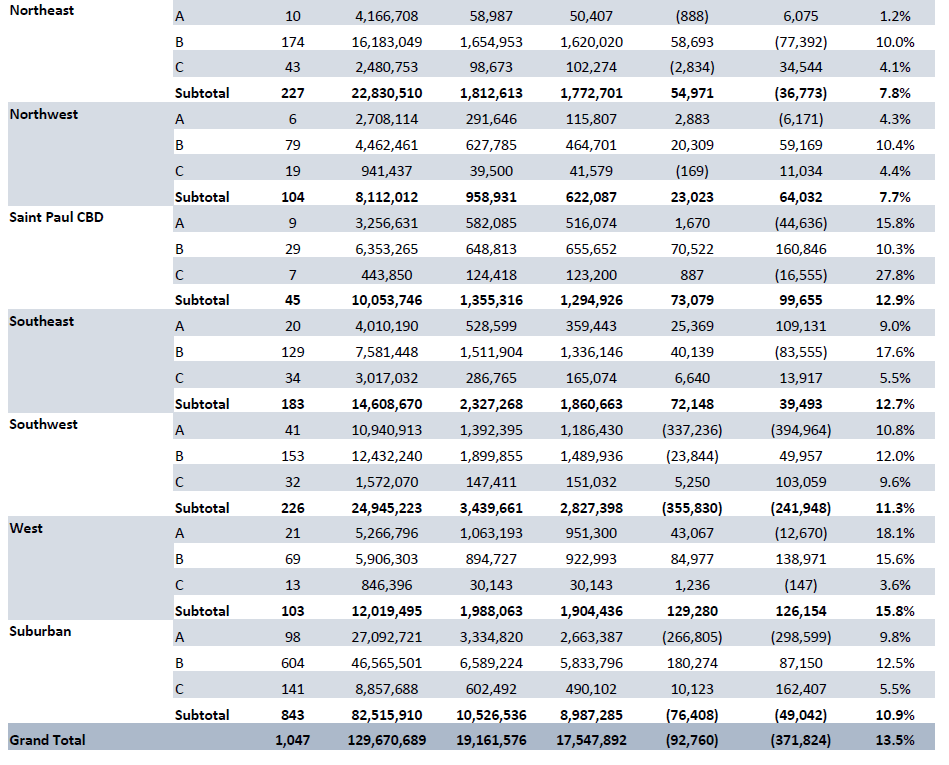

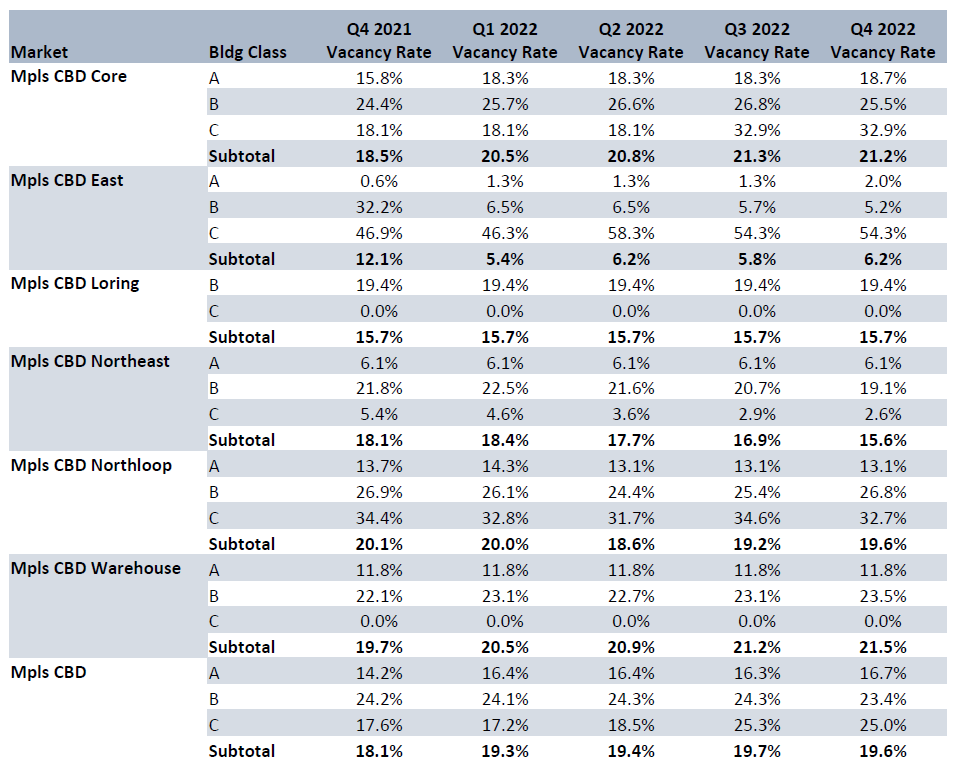

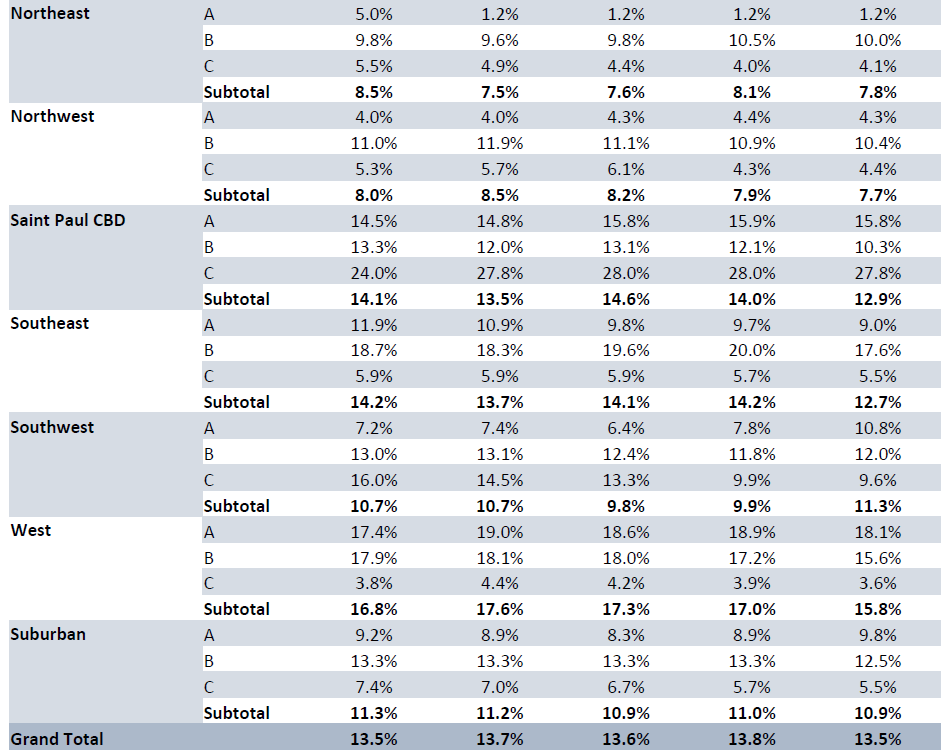

MARKET STATISTICS BY MARKET

(Direct Multi and Single Tenant)

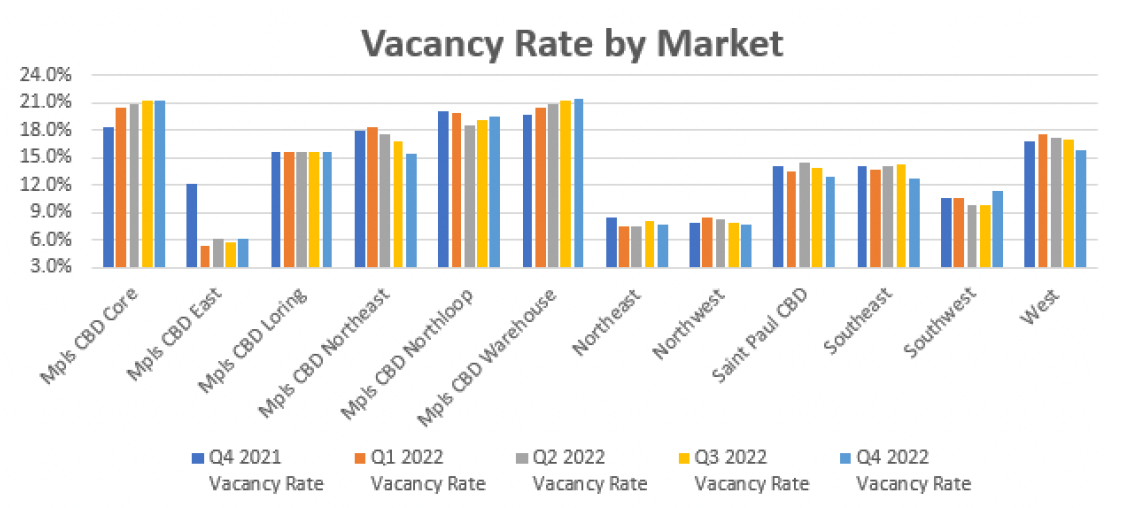

VACANCY RATES

(Direct Multi and Single Tenant)

VACANCY RATES BY BUILDING CLASS

(Multi and Single Tenant)

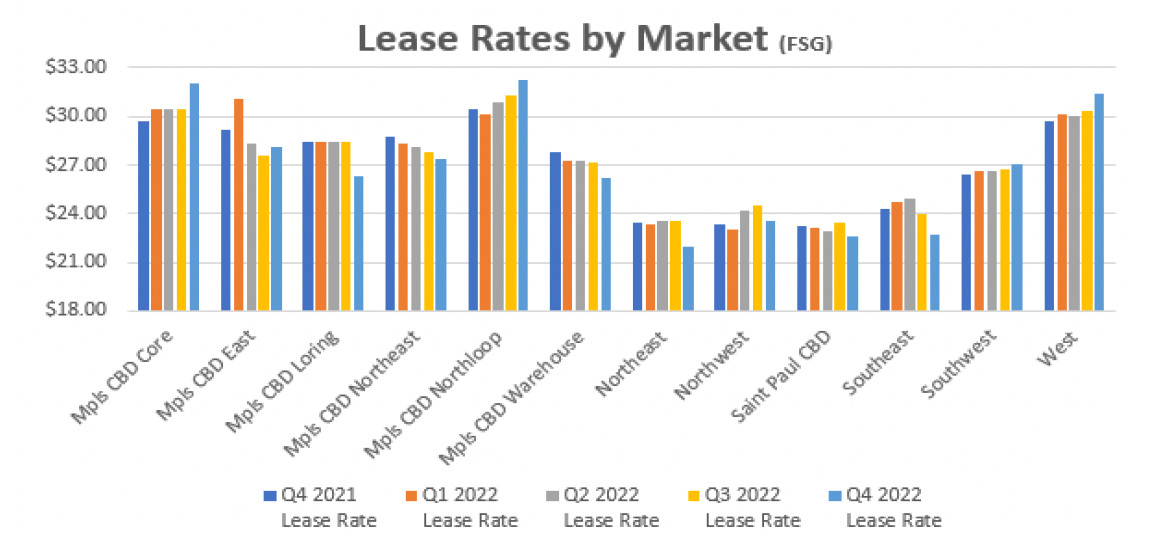

LEASE RATES BY MARKET

(Direct Multi and Single Tenant FSG)

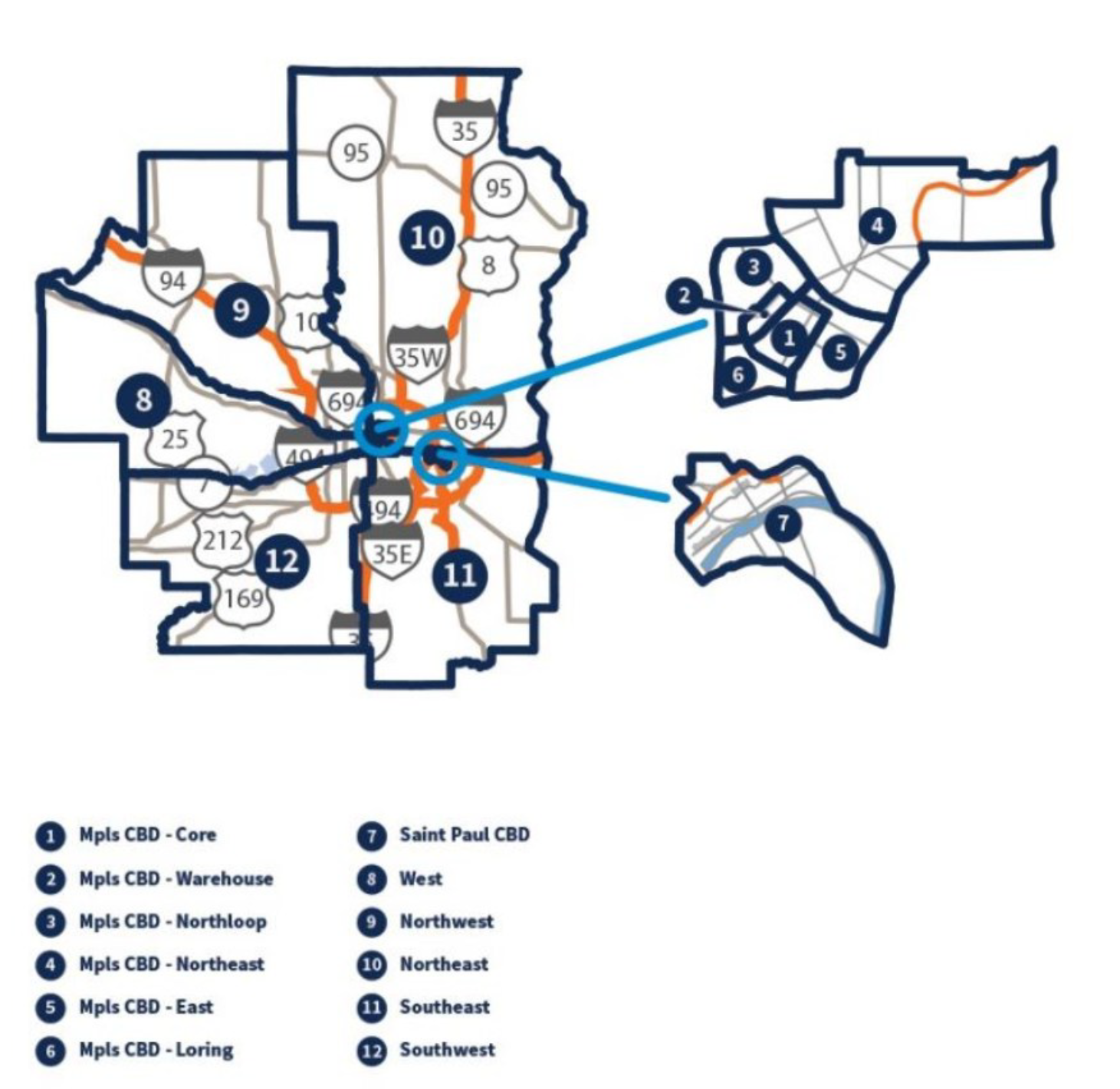

MARKET MAP

Office Advisory Experts

News

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...

Q1 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities industrial market enters 2025 with sustained momentum in absorption and decreasing vacancy By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities...

Q4 2024 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2024 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial market ends 2024 with strong occupancy but weak warehouse office absorption By: John Young, CCIM, Vice President - Real Estate Advisory The Twin Cities industrial market...