MARKET INSIGHT POST

Q4-2022 Minneapolis-St. Paul Industrial Market Update

Q4-2022 Minneapolis-St. Paul Industrial Market Update

MARKET RECAP:

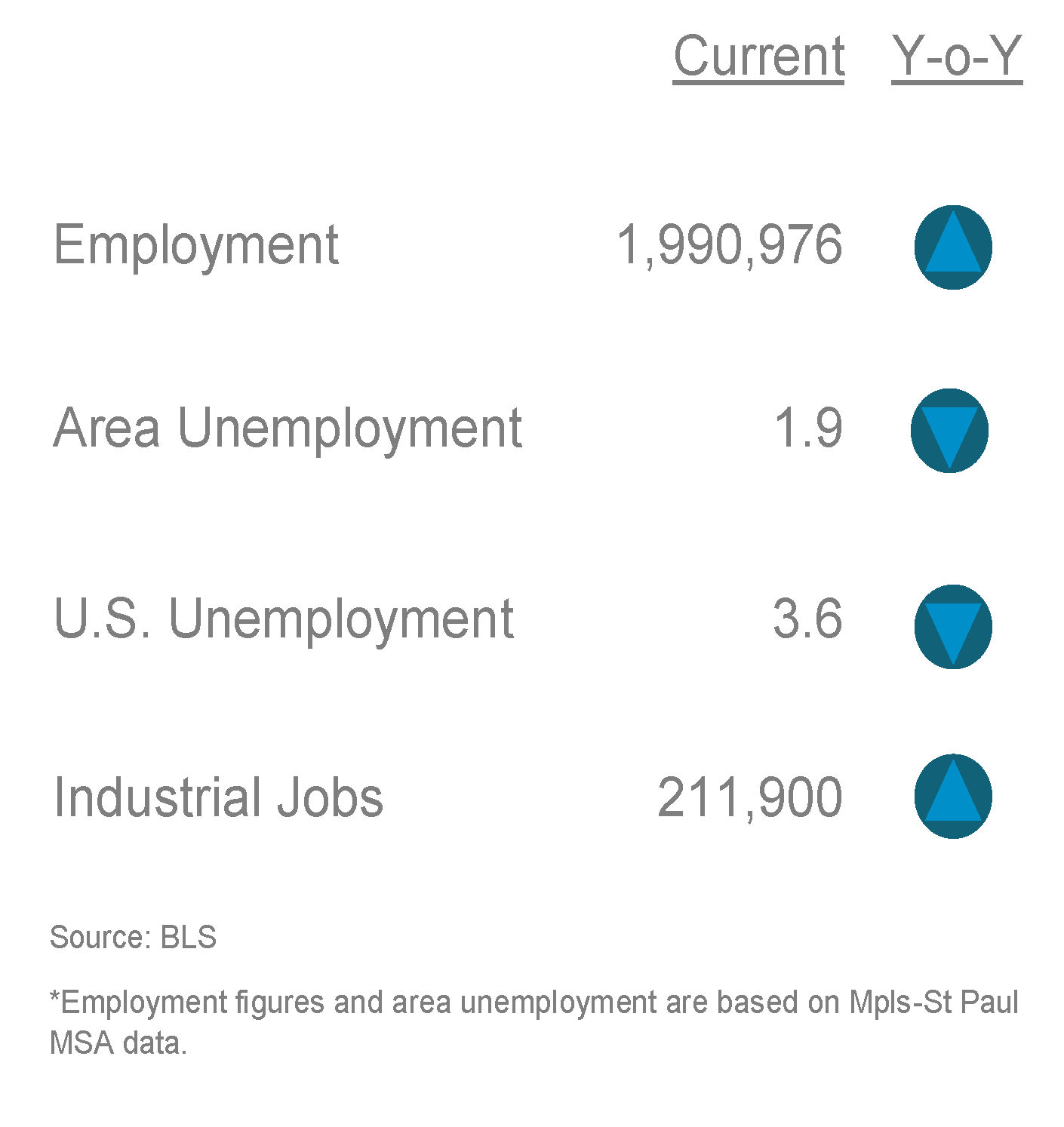

ECONOMIC OVERVIEW:

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET OVERVIEW:

MARKET HIGHLIGHTS:

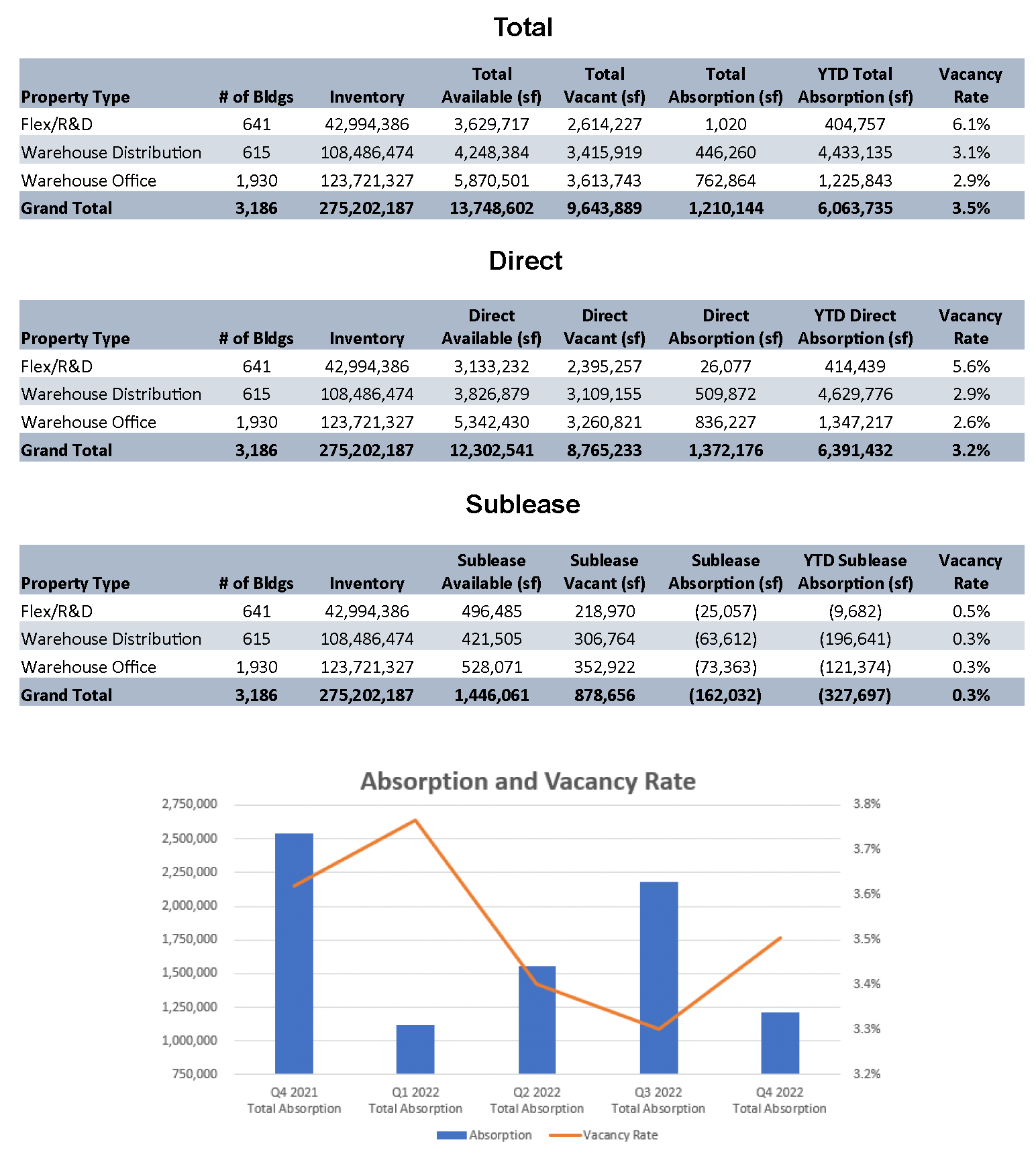

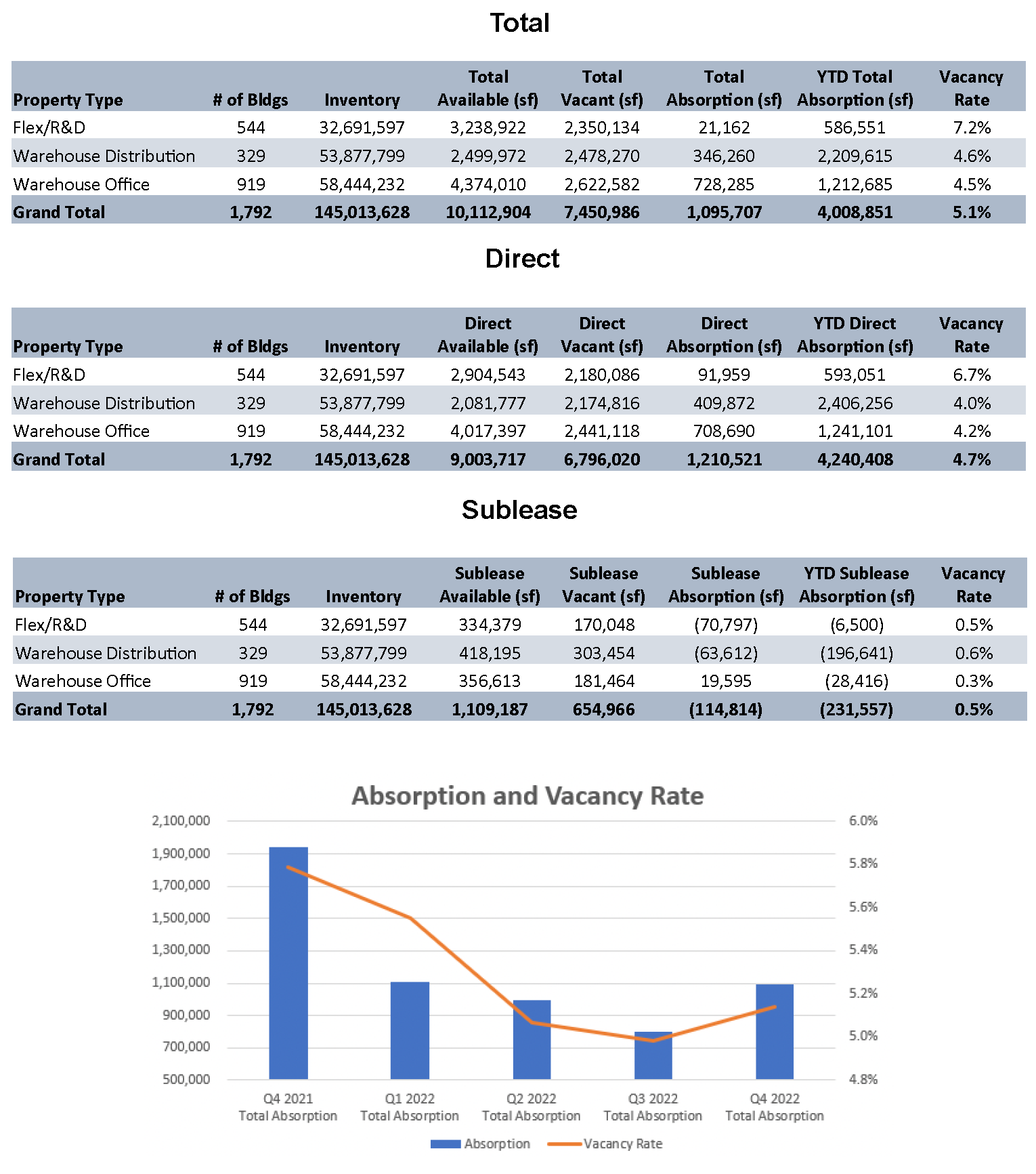

MARKET STATISTICS BY PROPERTY TYPE

Multi and Single Tenant:

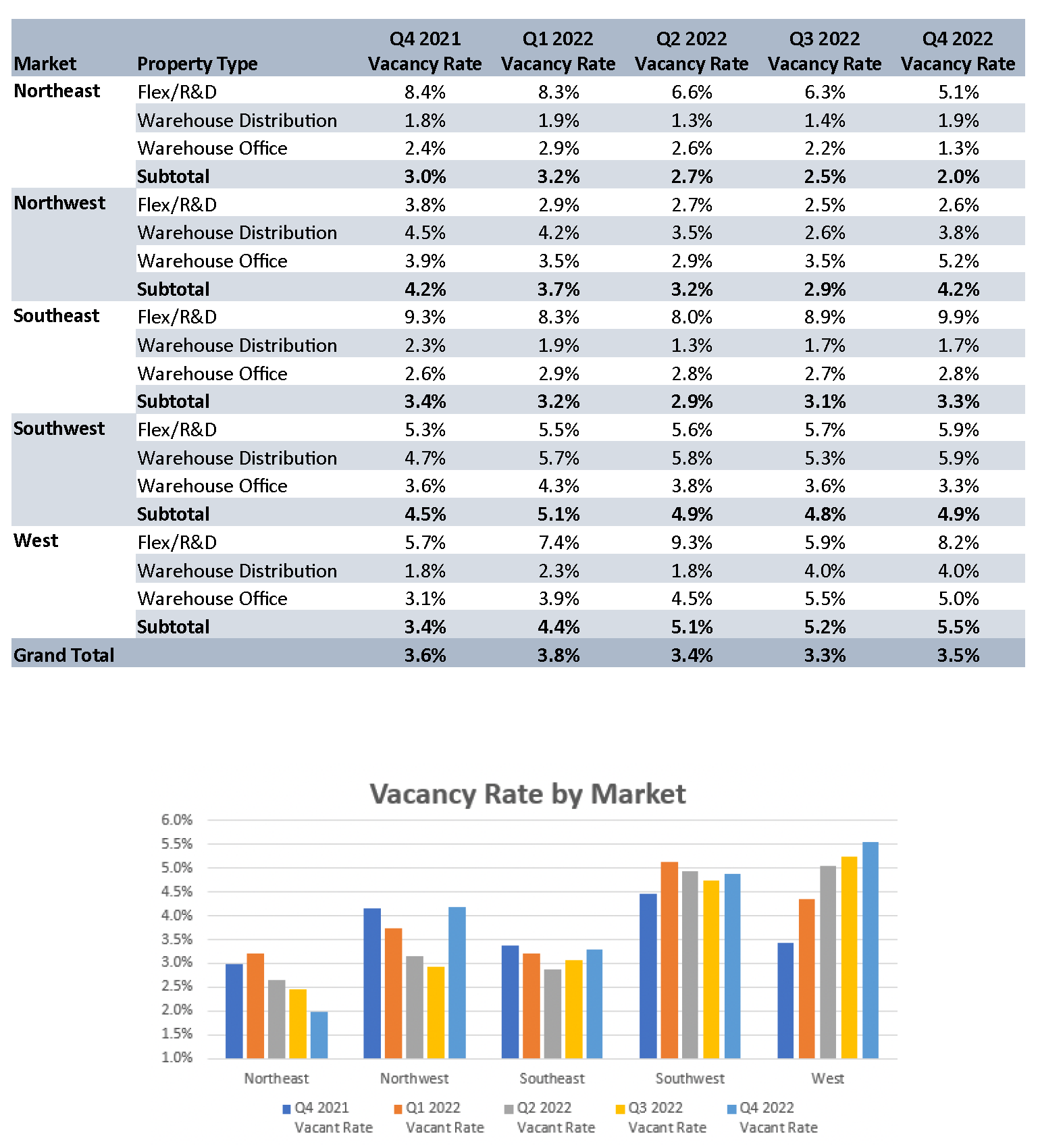

VACANCY RATES BY MARKET

Multi and Single Tenant:

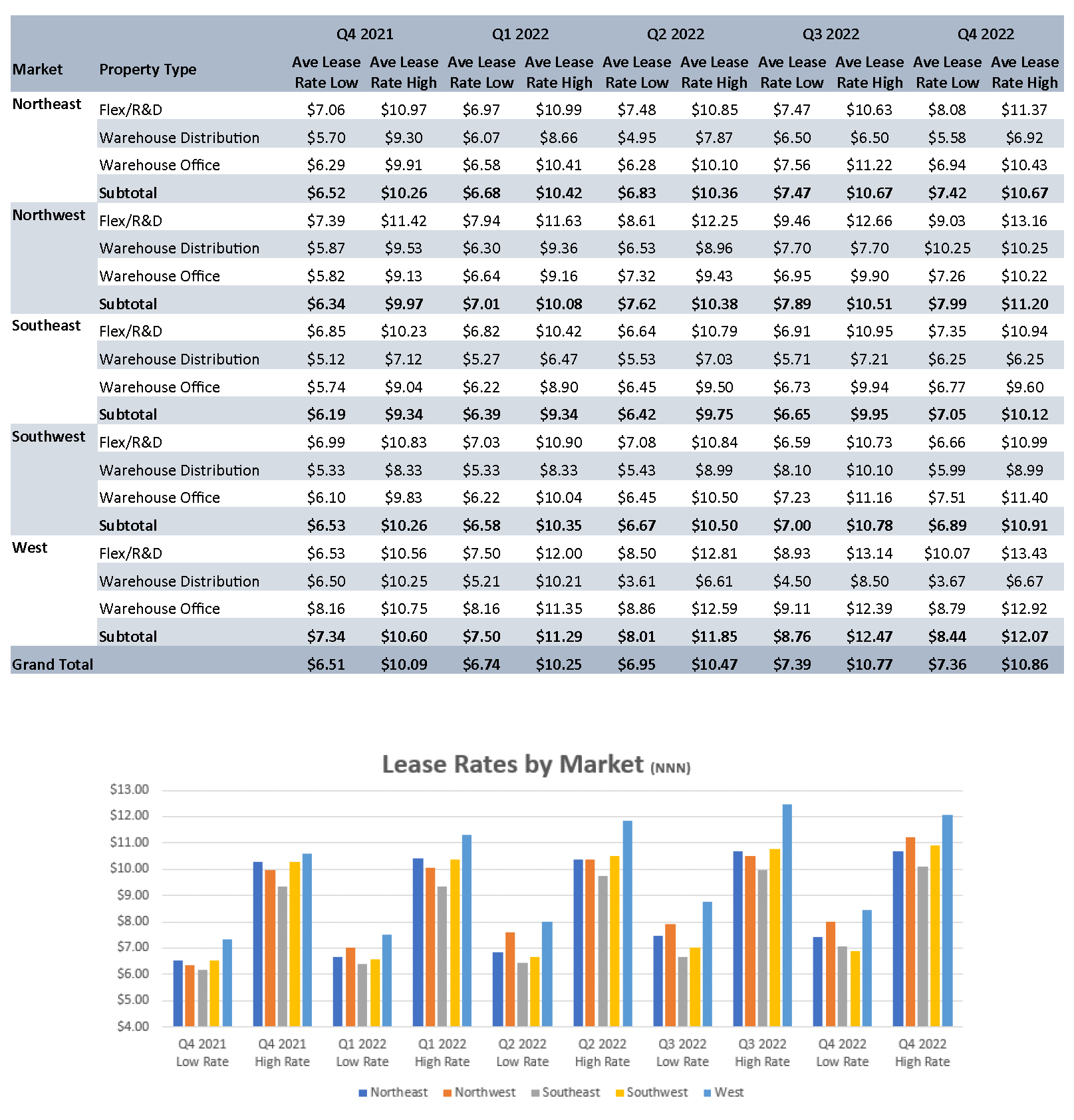

LEASE RATES BY MARKET

Multi and Single Tenant NNN:

MARKET STATISTICS BY PROPERTY TYPE

Multi Tenant:

Industrial Market Experts

News & Updates

Q4 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ4 2025 Minneapolis-St. Paul Office Market Summary Q4 2025 Twin Cities Office Insights: Stabilization with Selectivity Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released...

Q4 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial Market Holds Firm Despite Late-Year Softness By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities industrial market report provided by...

Expert Q&A-How Companies Can Prepare For the Next Downturn

NEWS POSTQ&A-How Companies Can Prepare for the Next DownturnNavigating Real Estate in an Uncertain EconomyExpert Q & A with Forte Leadership-Jim Jetland, SIOR-principal; Steve Brown, CCIM-principal, Phil Simonet-principal, and Paul Donovan-COOForte’s...