MARKET INSIGHT POST

Q2-2023 Minneapolis-St. Paul Office Market Update

Q2-2023 Office Market Update

ECONOMIC OVERVIEW:

MARKET OVERVIEW:

MARKET HIGHLIGHTS:

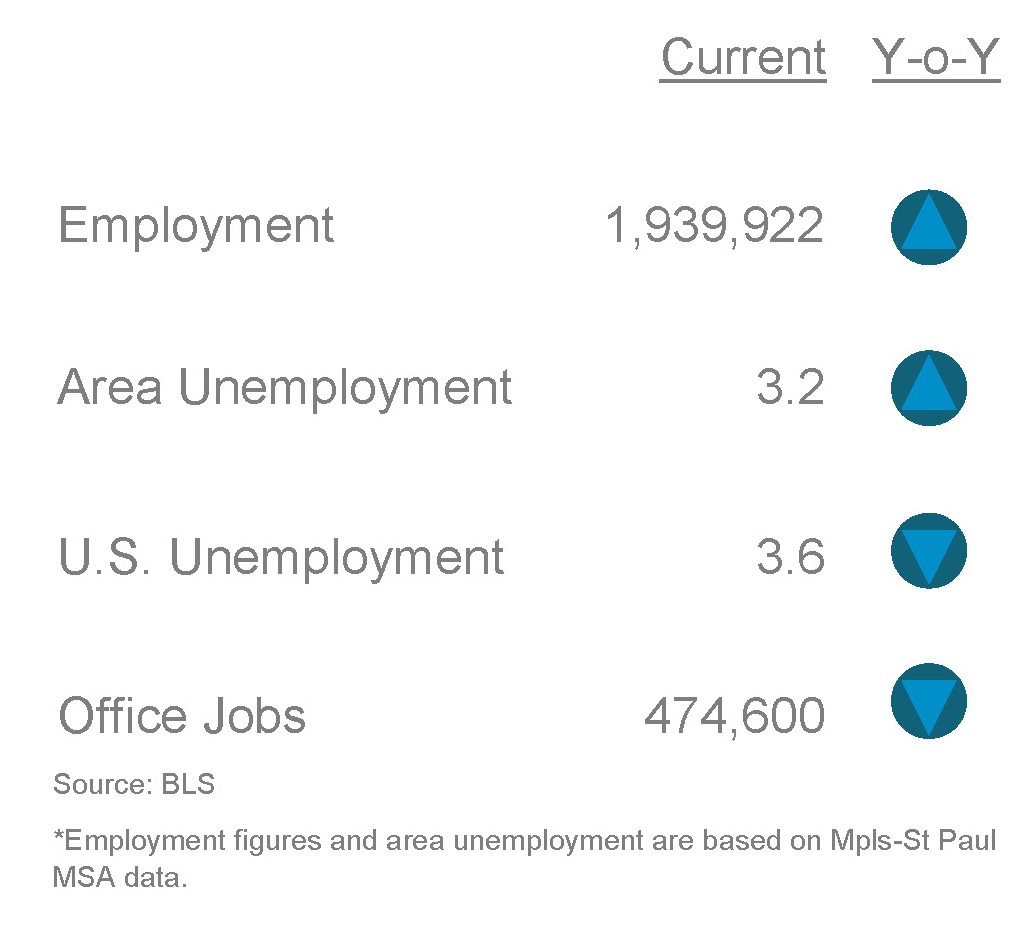

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET RECAP:

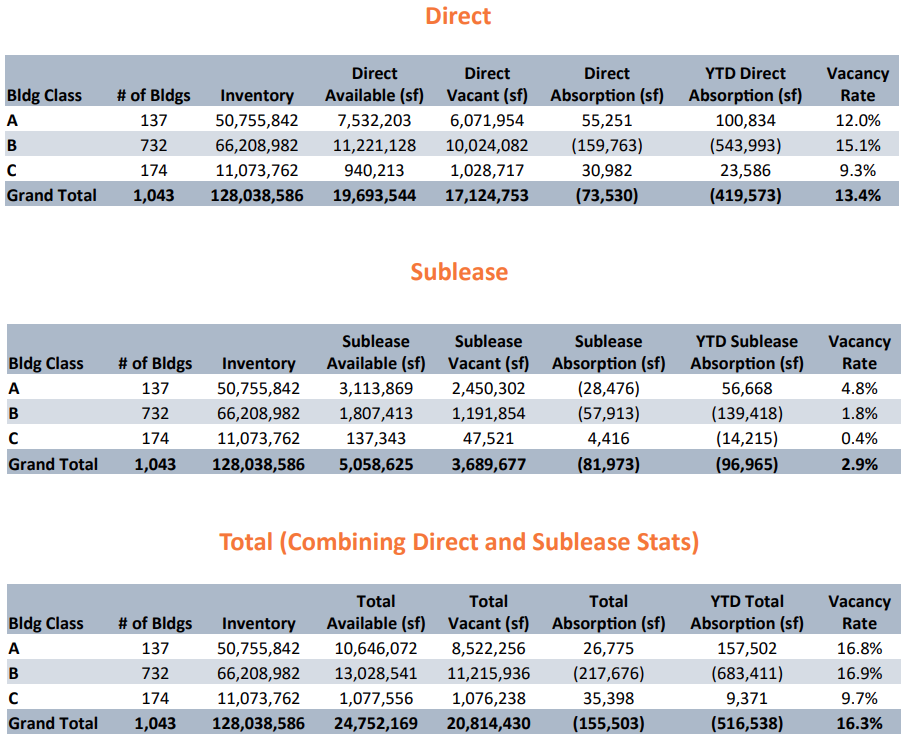

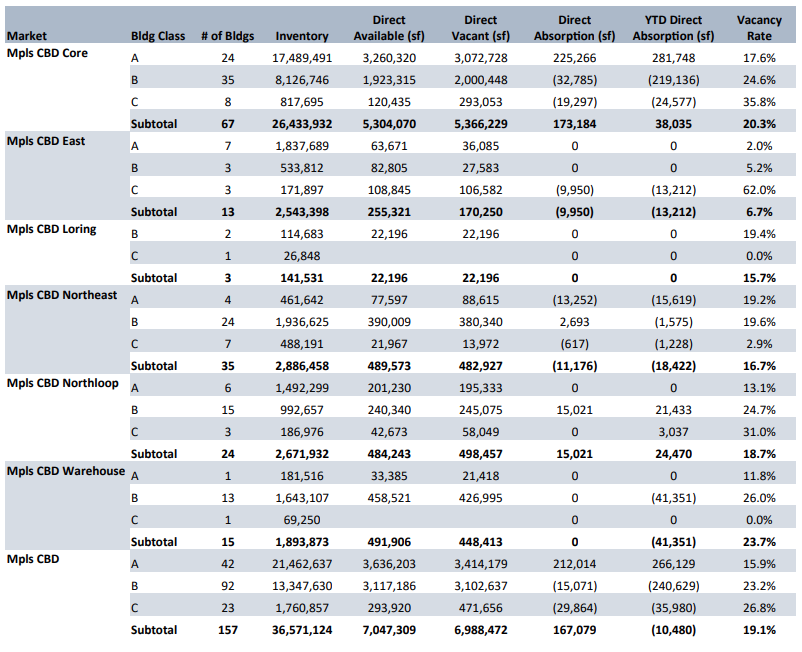

MARKET STATS BY BUILDING CLASS (Multi and Single Tenant)

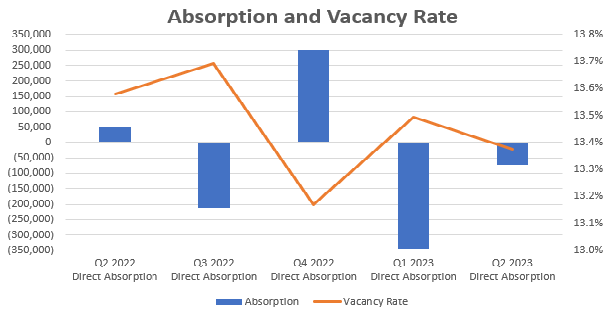

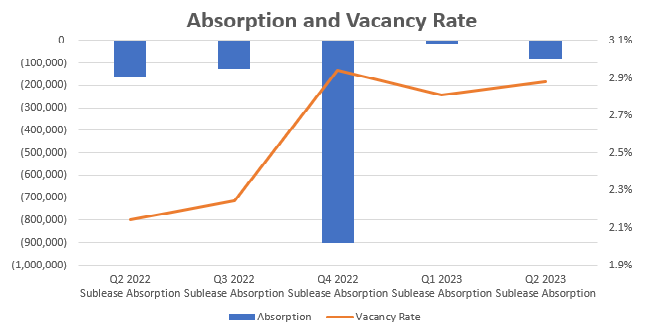

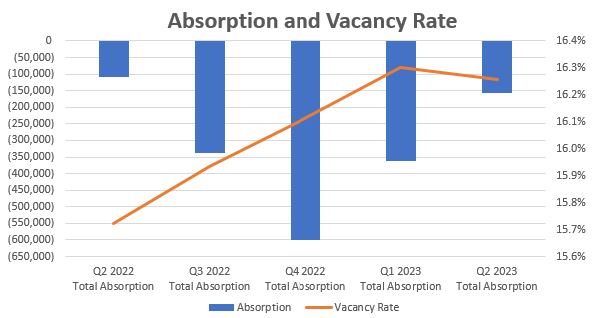

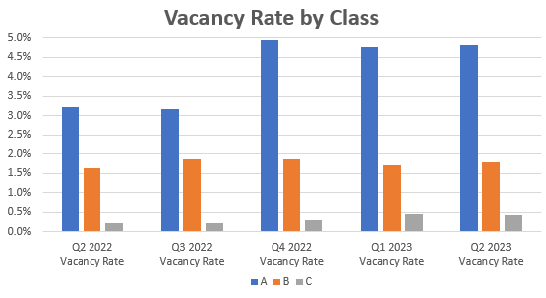

ABSORPTION & VACANCY RATE (Multi and Single Tenant)

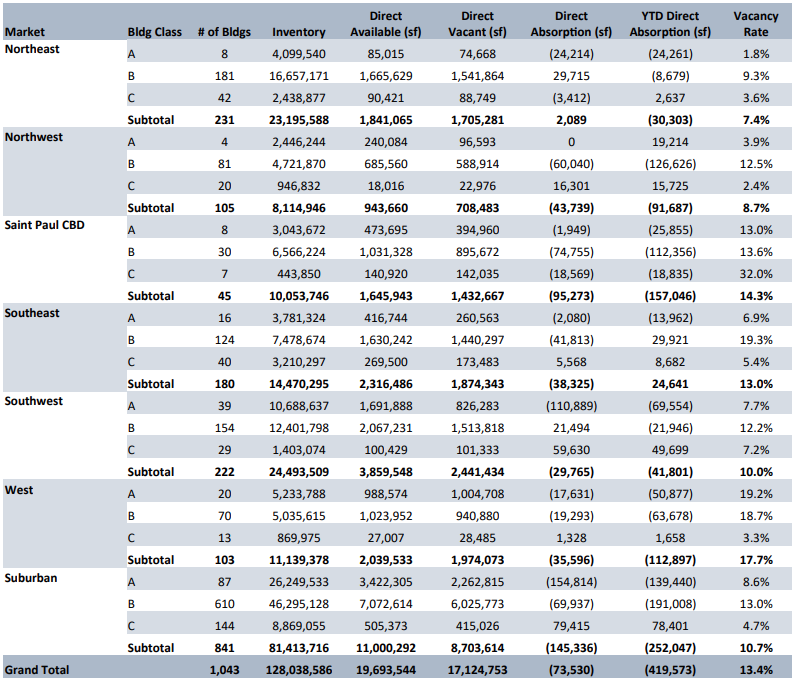

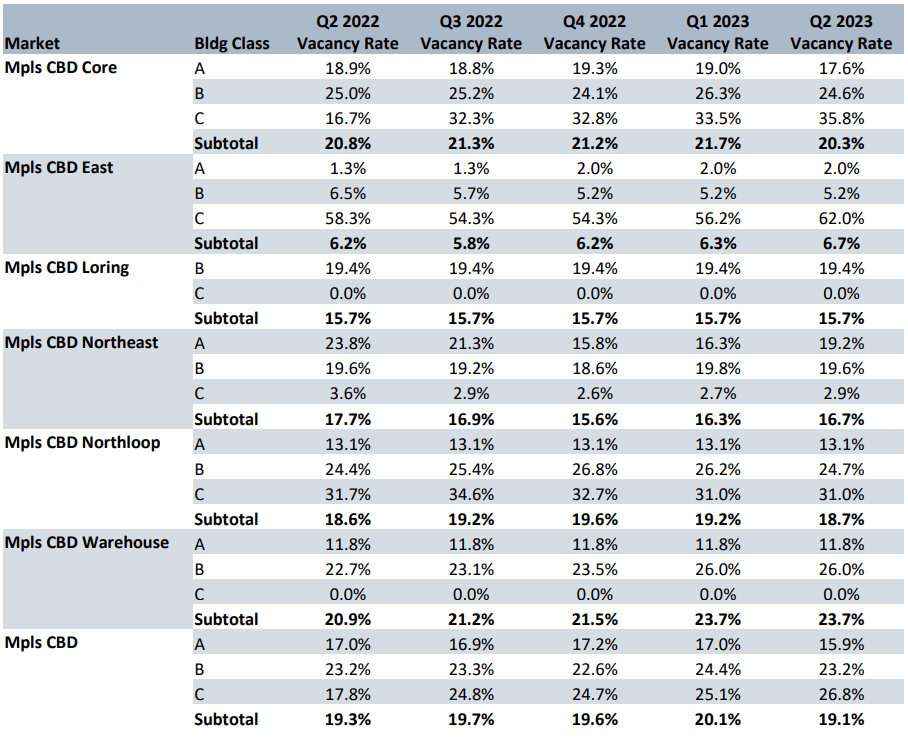

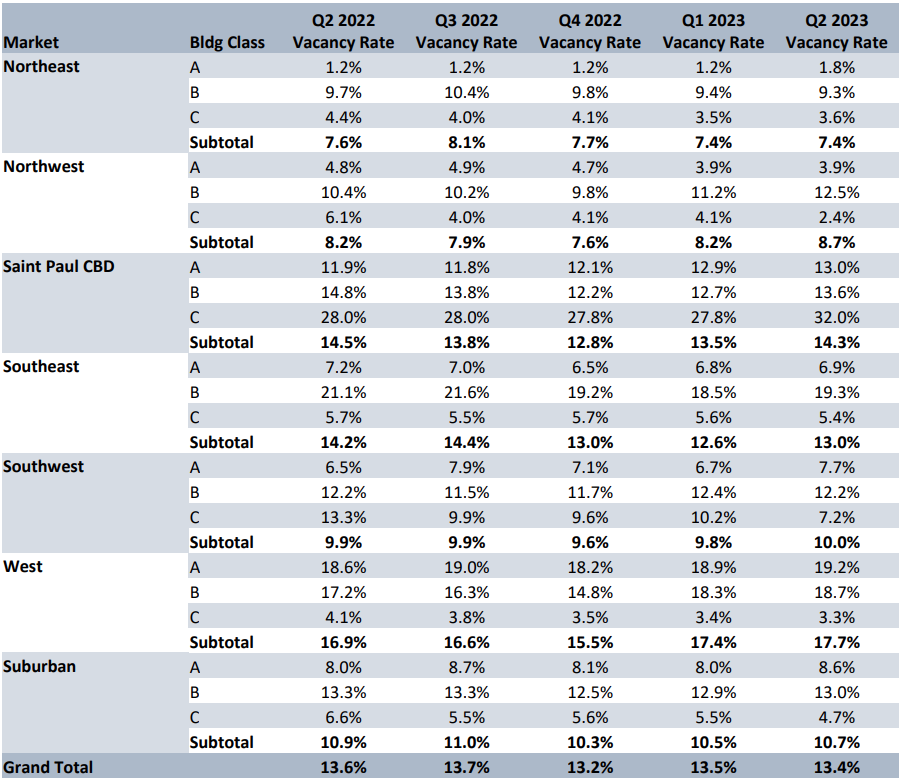

MARKET STATISTICS BY MARKET (Direct Multi and Single Tenant)

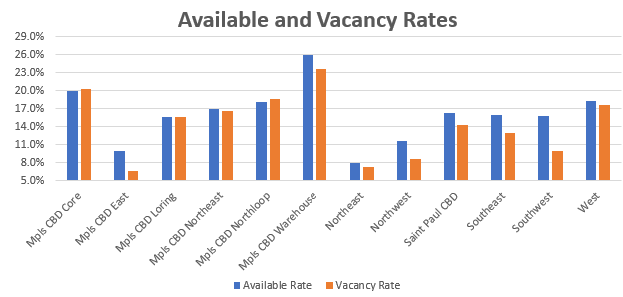

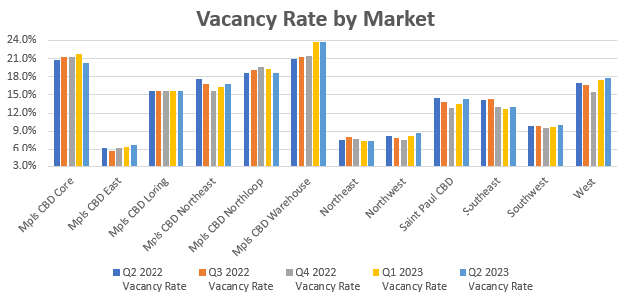

VACANCY RATES BY MARKET (Direct Multi and Single Tenant)

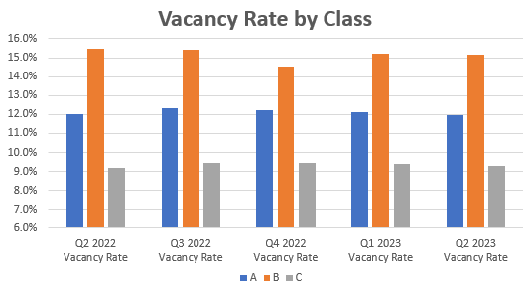

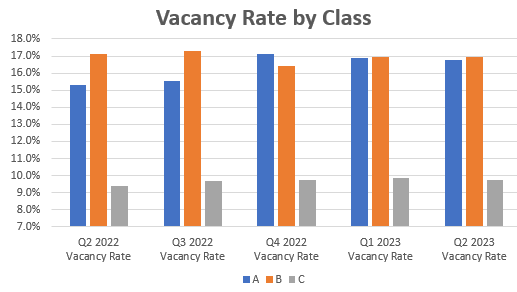

VACANCY RATES BY BUILDING CLASS (Multi and Single Tenant)

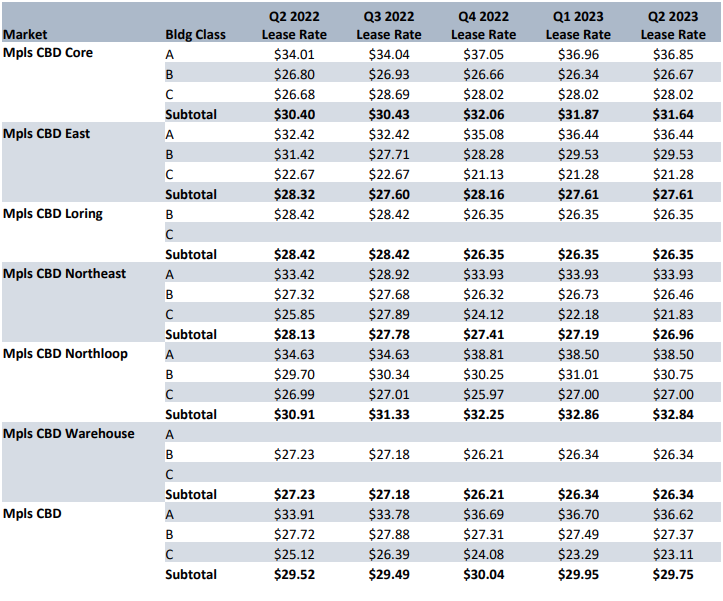

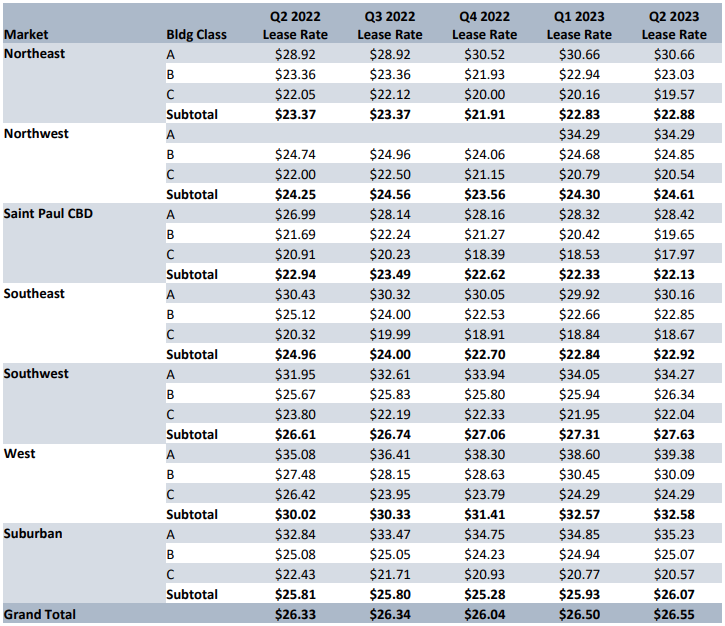

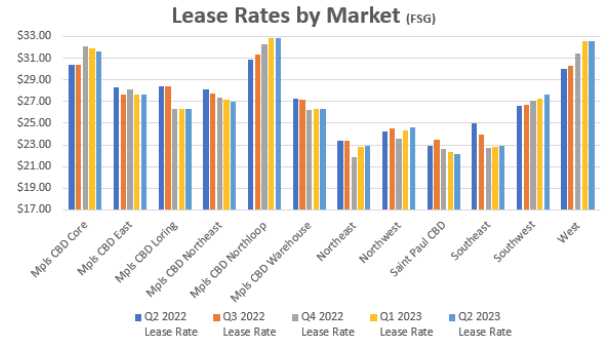

LEASE RATES BY MARKET (Direct Multi and Single Tenant FSG)

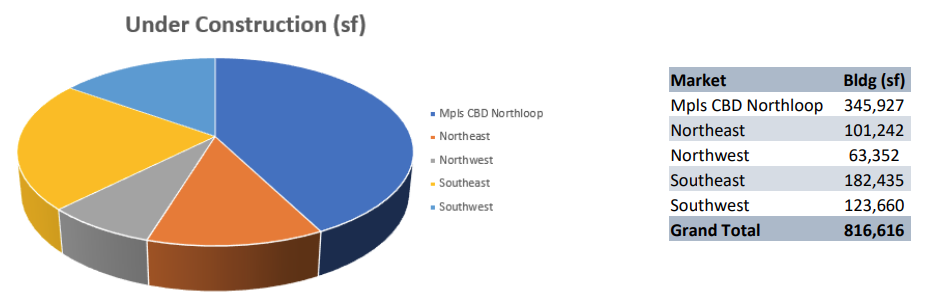

NEW DEVELOPMENTS

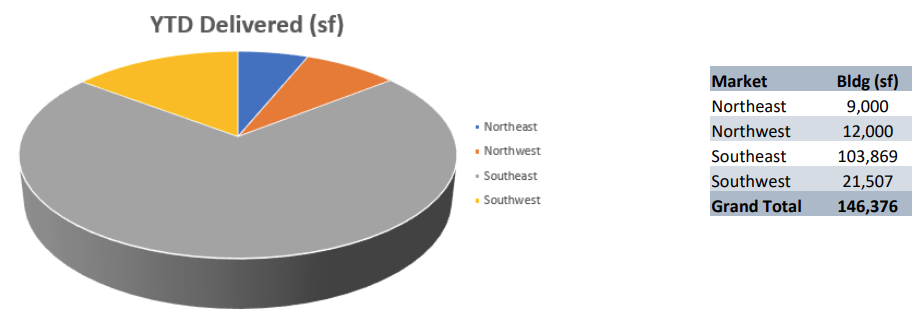

YEAR-TO-DATE DELIVERIES

MARKET MAP

Market Insight

Office Advisory Experts

News

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...

Q1 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities industrial market enters 2025 with sustained momentum in absorption and decreasing vacancy By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities...

Q4 2024 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2024 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial market ends 2024 with strong occupancy but weak warehouse office absorption By: John Young, CCIM, Vice President - Real Estate Advisory The Twin Cities industrial market...