MARKET INSIGHT POST

Q2-2023 Minneapolis-St. Paul Office Market Update

Q2-2023 Office Market Update

ECONOMIC OVERVIEW:

MARKET OVERVIEW:

MARKET HIGHLIGHTS:

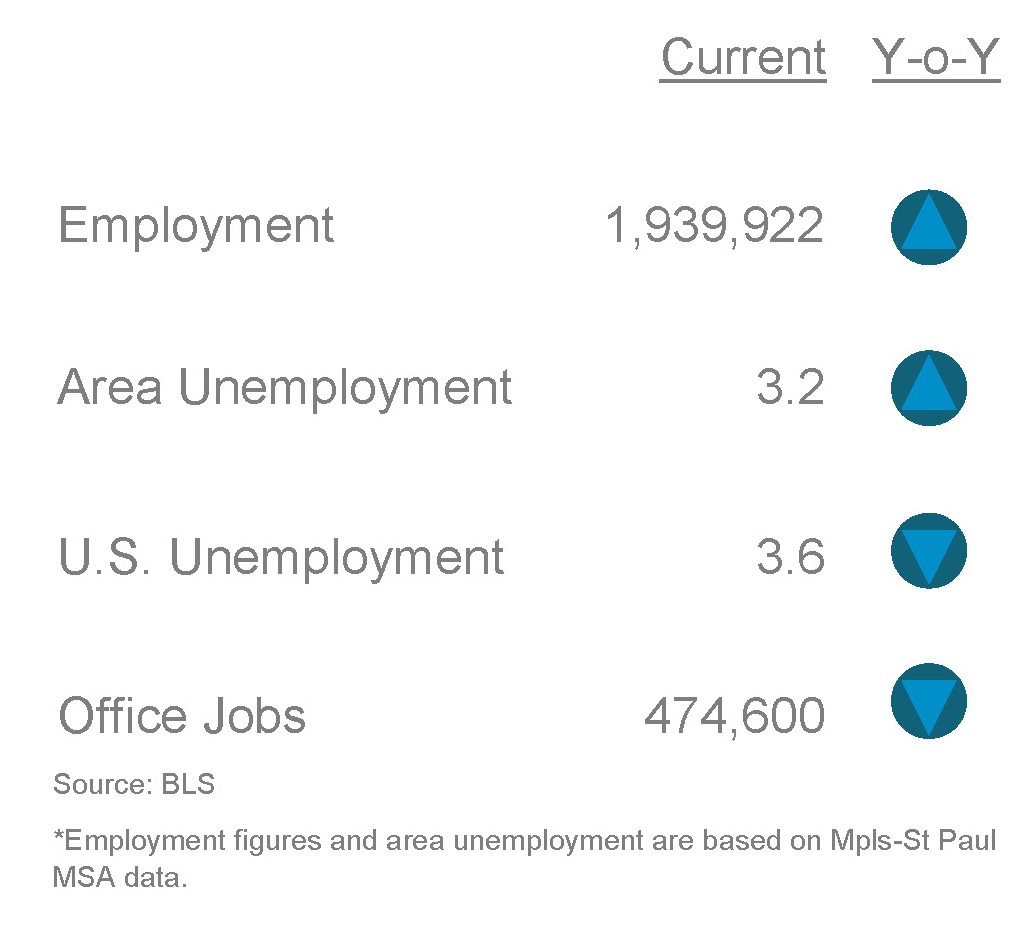

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET RECAP:

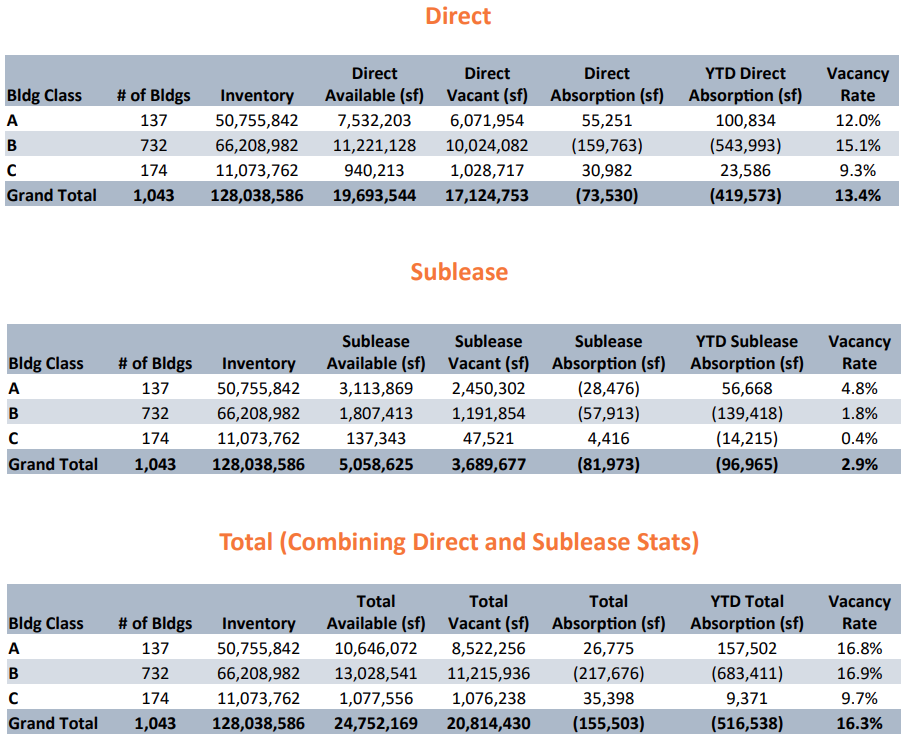

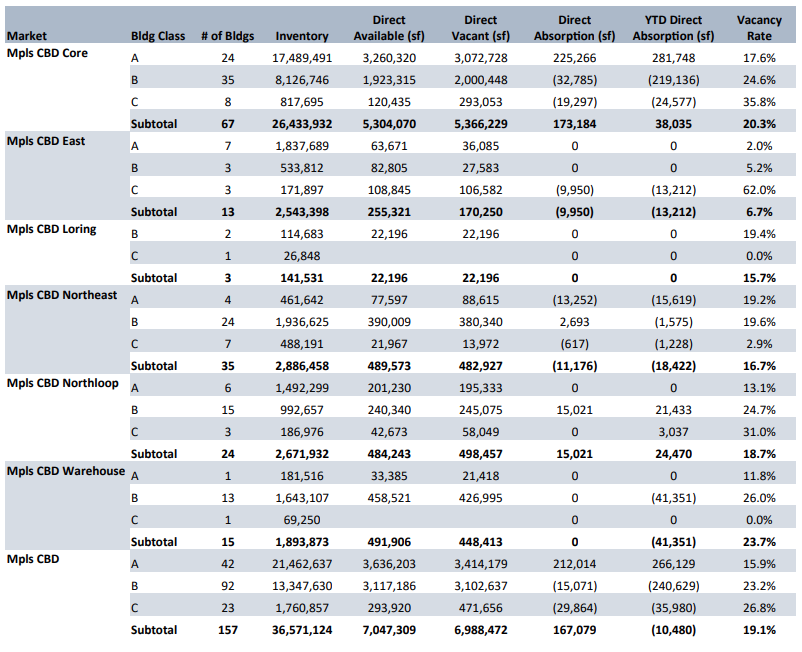

MARKET STATS BY BUILDING CLASS (Multi and Single Tenant)

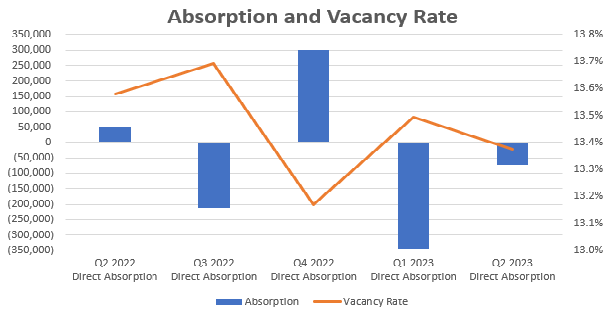

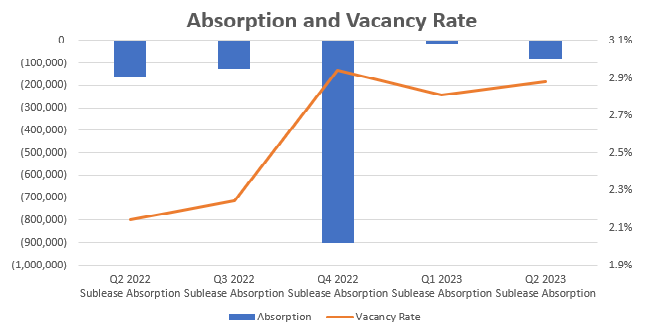

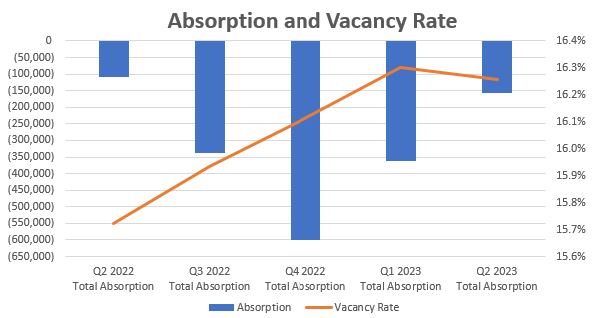

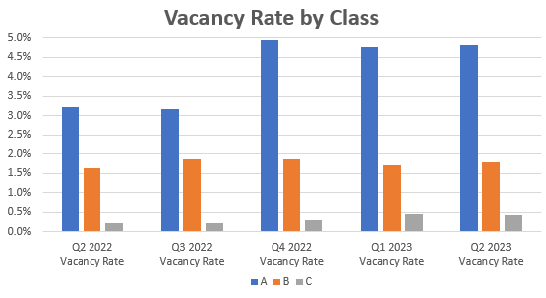

ABSORPTION & VACANCY RATE (Multi and Single Tenant)

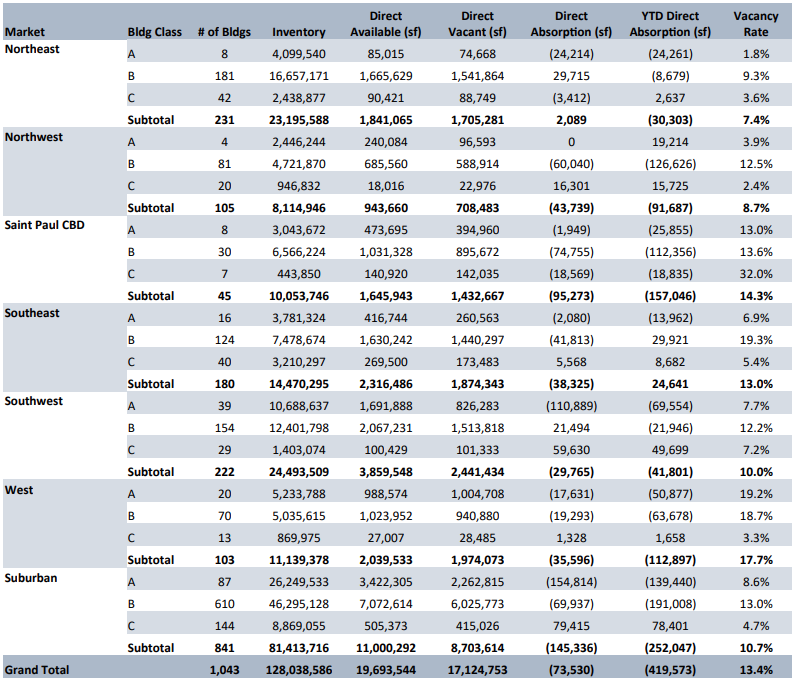

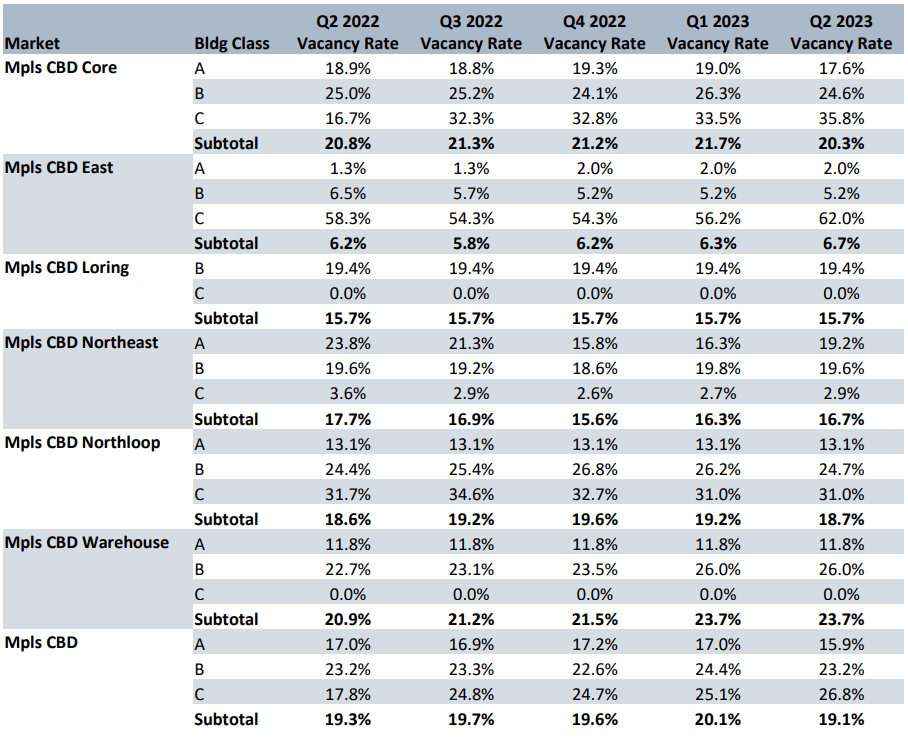

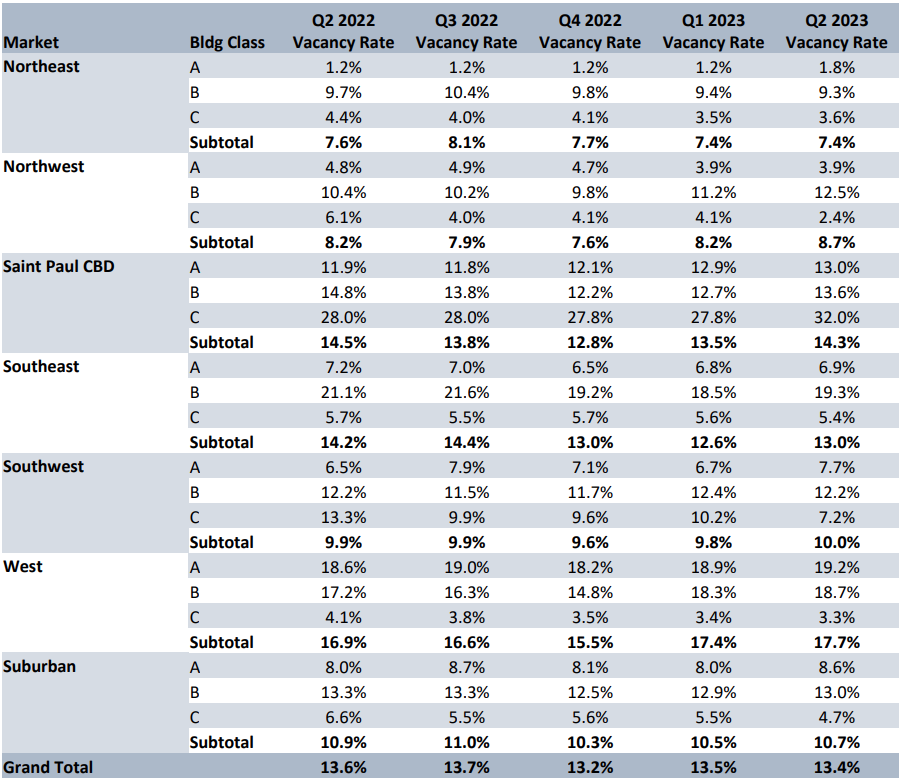

MARKET STATISTICS BY MARKET (Direct Multi and Single Tenant)

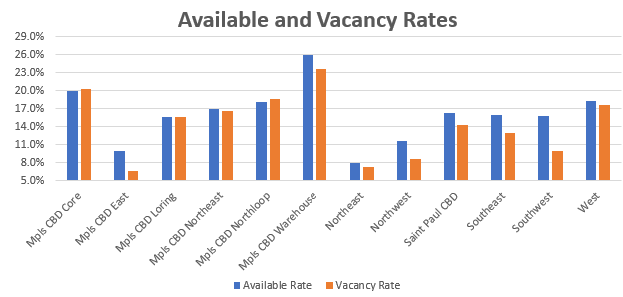

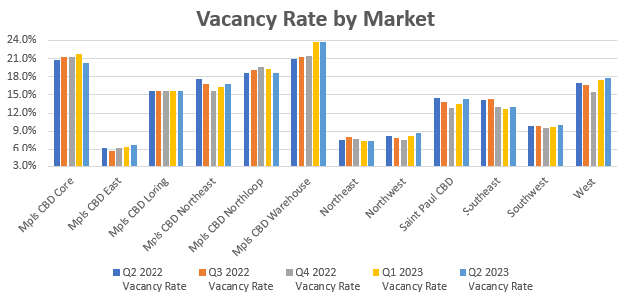

VACANCY RATES BY MARKET (Direct Multi and Single Tenant)

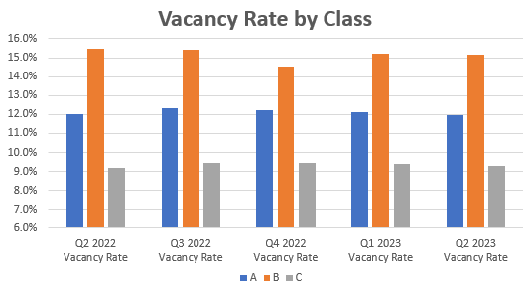

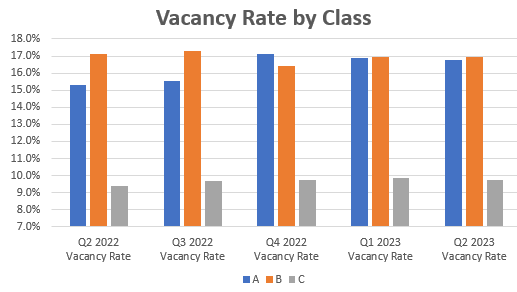

VACANCY RATES BY BUILDING CLASS (Multi and Single Tenant)

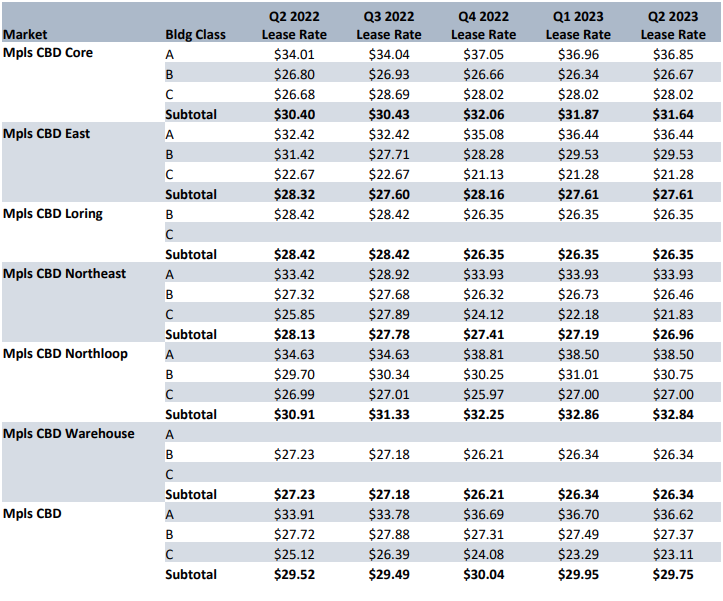

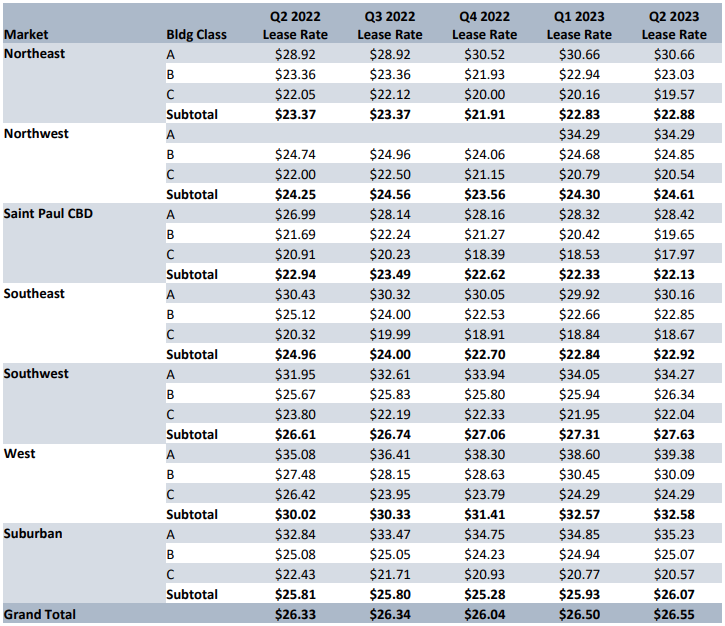

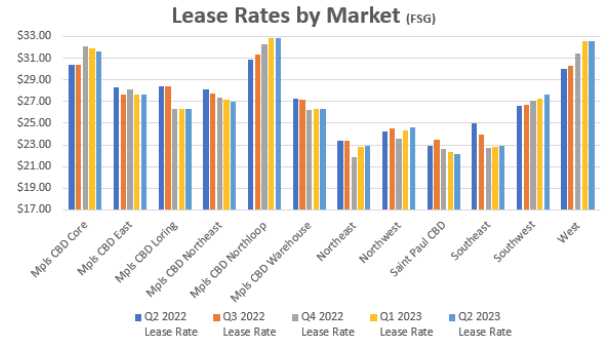

LEASE RATES BY MARKET (Direct Multi and Single Tenant FSG)

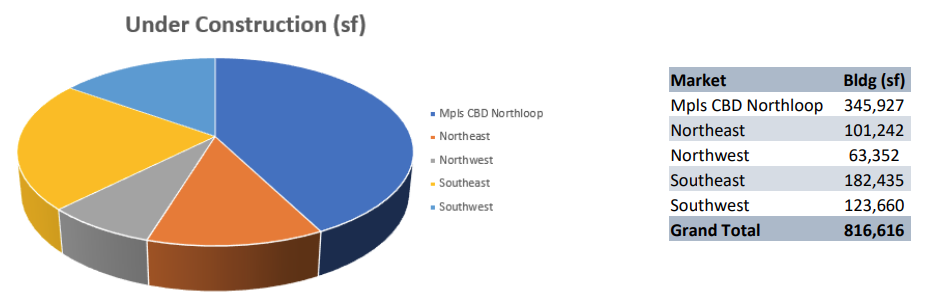

NEW DEVELOPMENTS

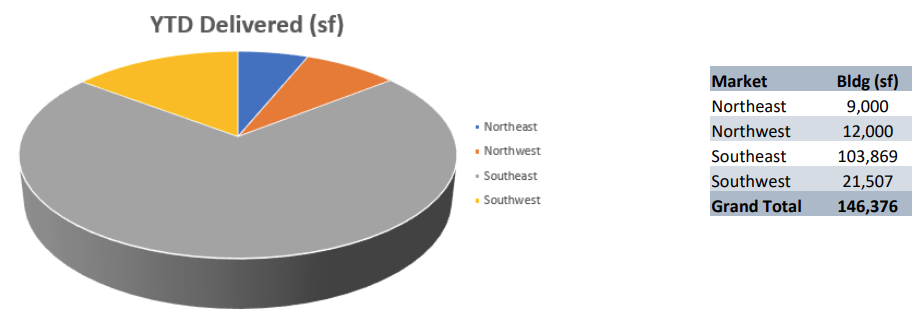

YEAR-TO-DATE DELIVERIES

MARKET MAP

Market Insight

Office Advisory Experts

News

Q2 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ2 2025 Minneapolis-St. Paul Office Market Summary Q2 2025 Twin Cities Office Insights: A Tale of Two Markets Forte’s Erik Nordstrom, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released by...

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...

Q1 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities industrial market enters 2025 with sustained momentum in absorption and decreasing vacancy By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities...