MARKET INSIGHT

Q3 2024 Minneapolis-St. Paul Industrial Market Summary

Industrial market continues to moderate with increasing vacancy, stabilizing lease rates

By: Dan Lofgren, Senior Vice President – Real Estate Advisory

Data from MNCAR/REDI shows that the Twin Cities industrial market further continued its moderation towards more historical norms. Vacancy rates in Q3 2024 in the multi-tenant market pushed up to 8.2% and incurred 442,800 SF of negative absorption for the quarter. The majority of this new vacancy is being driven by recent projects being delivered in both the Southeast and Southwest submarkets that are still searching for new tenants. Although the vacancy rates have crept closer to historical averages for the Twin Cities industrial market, rents have not yet plateaued as rates have increased yet again from Q2 2024. With additional vacancy being brought to the market in Q3 2024, tenants can hope the recent negative absorption will help lease rates lean in their favor for stabilize into 2025.

Investment sale activity has seen an uptick as investors are feeling more confident in both the capital markets and strong underlying fundamentals of industrial real estate. However, user sale activity has slowed over the past six months, which is not uncommon in an election year, particularly with an evolving interest rate environment that continues to find its footing. We expect user sale activity to increase in the coming months. Looking ahead, we expect further stabilization of lease rates as the market takes the recent negative absorption in Q3 2024 into account.

Q3-2024 Minneapolis-St. Paul Industrial Market Summary

MARKET RECAP:

All Properties:

Total Inventory: 297,233,170 sf

Total # of Buildings: 3,323

Absorption: 705,527 sf

Vacancy: 5.5%

Asking Rate Low: $9.95 NNN

Asking Rate High: $12.19 NNN

Under Construction: 2,392,533 sf

Multi-Tenant Properties

Total Inventory: 154,296,458 sf

Total # of Buildings: 1,844

Absorption: (442,835) sf

Vacancy: 8.2%

Asking Rate Low: $10.23

Asking Rate High: $12.37

ECONOMIC OVERVIEW:

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) increased 70 basis points to 3.9% for August 2024 from 3.2% for August 2023. The unemployment rate for the US was at 4.1% in September 2024 increasing 30 basis points from last year. State of Minnesota unemployment rate was 3.3%. The Mpls-St Paul MSA saw an decrease in job growth while industrial specific jobs decreased in job growth in manufacturing by 3,600 during the same period.

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET OVERVIEW:

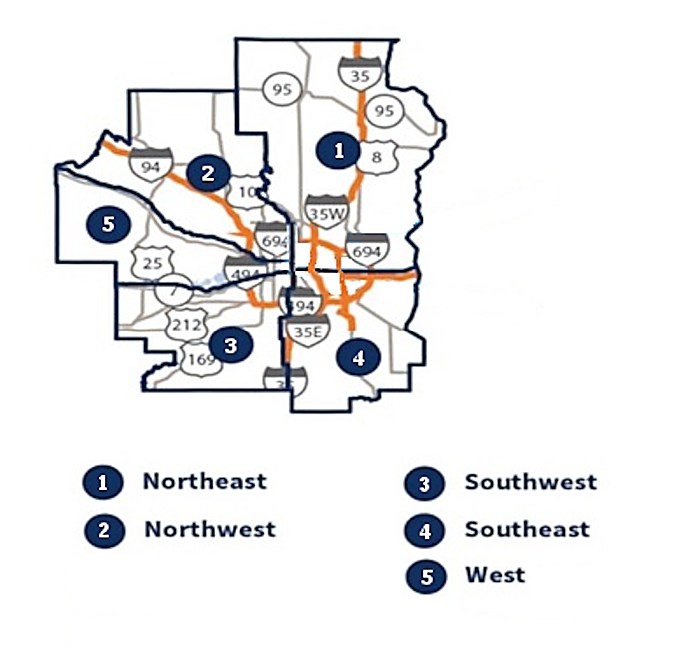

The Mpls-St Paul industrial market consists of 297.2 msf in eight counties across the metro. Overall, there was 705,500 sf of positive absorption for Q3 2024, bringing the YTD to 1.9 msf positive absorption. Multi-tenant only properties posted (442,800) sf negative absorption bringing the YTD to 144,500 sf positive absorption. The overall vacancy rate for the quarter was 5.5% and multi-tenant properties vacancy rate was 8.2%. To date, there are 25 construction projects throughout the market totaling 2.4 msf and 37 properties have been delivered this year with 4.5 msf.

MARKET HIGHLIGHTS:

At the close of Q3 2024, the market experienced 3.1 msf of leasing activity in 203 transactions. The West market showed the lowest vacancy rate of 3.3% while the Southwest market is at the top with 7.8% for all properties. The Southeast bested all markets with 825,600 sf positive absorption led by the new delivery of Fedex with 557,000 sf. The Southwest market posted the most negative absorption of (456,400) sf led by Shutterfly vacating 217,700 sf. Eighty seven properties sold totaling 3.9 msf for $402.6 million.

MARKET MAP:

Q3 2024 Industrial Market Report is created by Minnesota Commercial Real Estate Association. For more information, you can reach them at: www.mncar.org

Market Insight

Get access to all future Industrial Market Reports below

Industrial Market Experts

News & Updates

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...

Q1 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities industrial market enters 2025 with sustained momentum in absorption and decreasing vacancy By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities...

Q4 2024 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2024 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial market ends 2024 with strong occupancy but weak warehouse office absorption By: John Young, CCIM, Vice President - Real Estate Advisory The Twin Cities industrial market...