MARKET INSIGHT

Q1 2024 Minneapolis-St. Paul Office Market Summary

Forte Principal, Jim Jetland, provides insight to the Twin Cities office market report recently released by MNCAR/REDI.

While there are a few bright spots with the Twin Cities Office Market the general outlook continues to be problematic. Absorption in most submarkets continues to be negative, additional sublease space is coming on the market, the trend for less space required on corporate campuses makes for a trifecta of negative office market conditions. In addition, as more loans mature it is more difficult to refinance with higher interest rates, lower occupancy levels and a general national concern with the office market sector. In the next 1-2 years more Landlord’s and Lenders will be faced with some difficult decisions in solving for the current office market dynamics.

Unfortunately, this negative trend is expected to continue for the foreseeable future. While there are transactions being completed, the general trend for most companies is to reduce their overall office footprint which results in consistent negative absorption. Until this trend reverses direction, the Twin Cities Office Market will continue to be challenged.

Q1-2024 Minneapolis-St. Paul Office Market Summary

MARKET RECAP:

All Properties:

Total Inventory: 126,409,339 sf

Total # of Buildings: 1,035

Absorption: (216,813) sf

Vacancy: 17.7%

Asking Rate: $27.10 NNN

New Construction: 381,593 sf

Multi-Tenant Properties

Total Inventory: 87,633,390 sf

Total # of Buildings: 837

Absorption: (216,813) sf

Vacancy: 22.0%

Asking Rate: $27.11

ECONOMIC OVERVIEW:

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) increased 10 basis points to 3.3% for February 2024 from 3.2% for February 2023. The

unemployment rate for the US was at 3.9% in February 2024 increasing 30 basis points from last year. State of Minnesota unemployment rate was 2.7%. The Mpls-St Paul MSA saw an increase in job growth but office decreased in job growth in professional, financial and information with 15,900 during the same period.

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET OVERVIEW:

The Mpls-St Paul office market consists of 126.4 msf of space in seven metro counties. This region posted (216,800) sf of negative absorption for Q1 2024 and showed an overall vacancy rate of 17.7% for all properties. This quarter showed (873.200) sf of direct negative absorption while subleases accounted for 656,400 sf positive absorption led by UHG lease expiring and increasing direct vacancy by 451,000 sf in the Southwest market. Multi-tenant only properties posted 22.0% vacancy with (216,800) sf negative absorption. During Q1 2024 there were 2 construction projects throughout the market totaling 381,500.

MARKET HIGHLIGHTS:

During Q1 2024, the market experienced over 1.0 msf of leasing activity in 306 transactions. For direct leasing, Mpls CBD markets posted (190,800) sf negative absorption. The suburban markets posted (629,300) sf. St Paul CBD posted (53,000) sf negative absorption. The West market had the most direct positive absorption of 74,600 sf. The largest positive absorption was Thomson Reuters subleasing 308,000 sf in the Southeast market. Seventy four properties with 1.1 msf sold for $154 million this quarter.

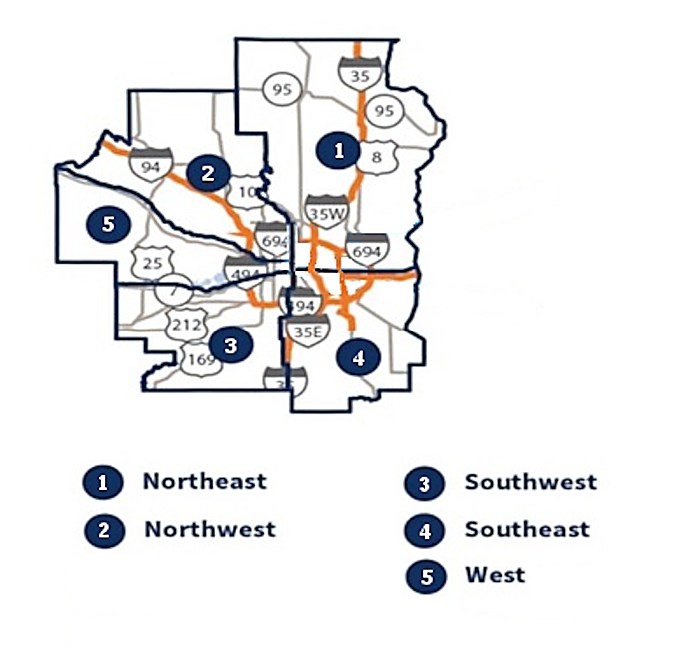

MARKET MAP:

Q1 2024 Office Market Report is created by Minnesota Commercial Real Estate Association. For more information, you can reach them at: www.mncar.org

Market Insight

Get access to all future Office Market Reports below

Office Market Experts

News & Updates

Q2 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ2 2025 Minneapolis-St. Paul Office Market Summary Q2 2025 Twin Cities Office Insights: A Tale of Two Markets Forte’s Erik Nordstrom, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released by...

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...

Q1 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities industrial market enters 2025 with sustained momentum in absorption and decreasing vacancy By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities...