MARKET INSIGHT

Q4 2025 Minneapolis-St. Paul Industrial Market Summary

Twin Cities Industrial Market Holds Firm Despite Late-Year Softness

By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities industrial market report provided by MNCAR/REDI.

The Twin Cities industrial market closed out 2025 on stable footing, though activity cooled in the fourth quarter following a stronger first half of the year. Total industrial inventory now stands at approximately 303.8 million square feet across the metro. Q4 posted (660,000 SF) of net absorption, bringing year-to-date absorption to roughly 250,000 SF positive, signaling that demand remains present but uneven as occupiers take a more cautious approach to expansion. Overall vacancy ticked up to 6.0%, with multi-tenant vacancy higher at 8.5%, reflecting softness in smaller-bay and commodity product.

Leasing velocity remained healthy to close the year, with 2.7 million SF leased across 211 transactions in Q4 alone. On the capital markets side, investor appetite for industrial real estate in the Twin Cities continues to outperform other asset classes, with 95 properties totaling 4.9 million SF trading for approximately $499 million during the year.

Submarket Performance

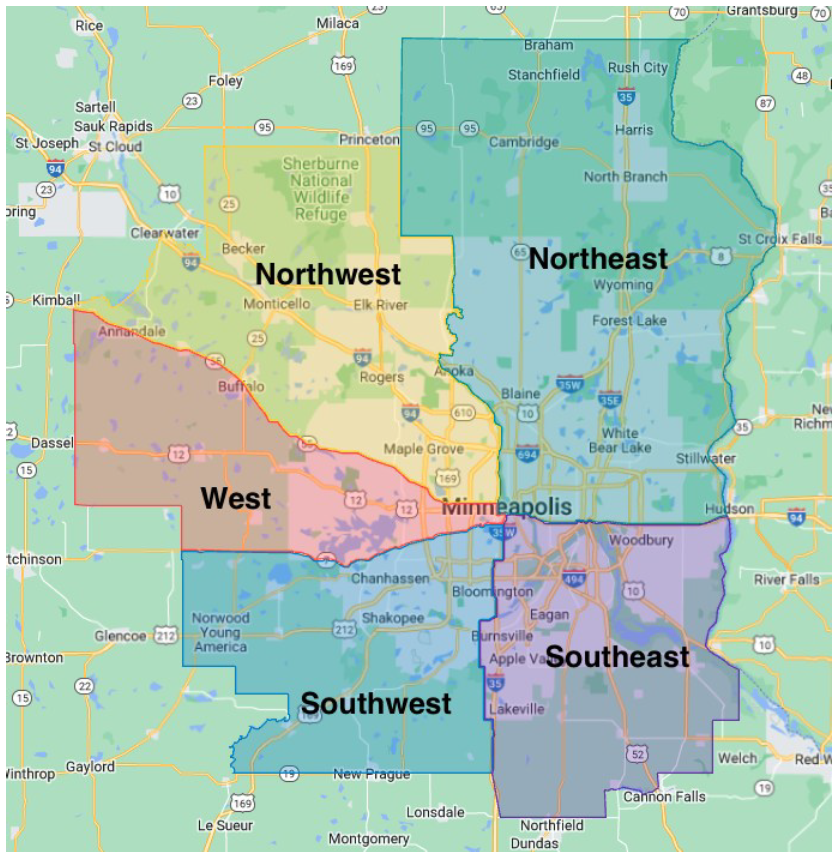

-

- Northwest: The tightest submarket in the metro with 4.6% vacancy, supported by consistent bulk warehouse demand and limited new vacancy.

- Southeast: Led the region in absorption with +201,000 SF for the quarter, driven in part by owner-user activity, including Livcharter’s purchase of a 212,400 SF facility.

- Northeast: Remains one of the most stable markets with 4.7% vacancy, though absorption turned modestly negative in Q4.

- Southwest: Continued to face headwinds with (346,500 SF) of negative absorption and the metro’s highest vacancy at 8.2%, driven by larger tenant move-outs.

- West: Smaller submarket with higher volatility, ending the quarter at 6.8% vacancy and negative absorption.

Development Pipeline

Development activity remains active but increasingly tenant-driven. There are 32 projects totaling approximately 6.8 million SF under construction, with 3.5 million SF delivered year-to-date. The Southeast continues to account for the majority of new deliveries, while speculative development remains measured by national standards. Most new construction is either build-to-suit or highly pre-leased, limiting the risk of significant oversupply.

Market Dynamics

-

- Rents: Asking rates continue to hold firm despite rising vacancy, with metro-wide asking rents ranging from $8.73 to $11.27 NNN. Newer, higher-clear distribution product and well-located infill facilities continue to command premium pricing.

- Tenant Conditions: Tenants have slightly more leverage than in prior years, particularly in multi-tenant parks and older warehouse product. That said, well-located bulk space and modern facilities remain competitive, with limited true Class A availability in the Northwest and Northeast submarkets.

- Investor Activity: Nearly $500 million in 2025 sales volume underscores continued institutional and private capital confidence in Twin Cities industrial fundamentals, supported by durable occupancy and long-term tenant demand.

Outlook

Looking ahead to 2026, the Twin Cities industrial market remains fundamentally sound, albeit in a more normalized phase following the post-pandemic surge. While absorption has cooled and vacancy has trended upward, demand from logistics, manufacturing, and regional distribution users remains intact. With speculative development still disciplined and construction largely tenant-driven, the market is well positioned to absorb new supply over time. For tenants, the current environment offers improved negotiating leverage compared to the last few years, while landlords with well-located, modern facilities should continue to see steady demand and durable rent levels.

Q4-2025 Minneapolis-St. Paul Industrial Market Summary

MARKET RECAP:

All Properties:

Total Inventory: 303,792,276 sf

Total # of Buildings: 3,383

Absorption: (660,030) sf

Vacancy: 6.0%

Asking Rate Low: $8.73 NNN

Asking Rate High: $11.27 NNN

Under Construction: 6,756,727 sf

Multi-Tenant Properties

Total Inventory: 155,625,472 sf

Total # of Buildings: 1,865

Absorption: (44,616) sf

Vacancy: 8.5%

Asking Rate Low: $8.79 NNN

Asking Rate High: $11.21 NNN

ECONOMIC OVERVIEW:

Historically, according to the U.S. Bureau of Labor Statistics (BLS), the Mpls-St Paul metropolitan statistical area (MSA) has experienced relatively stable unemployment and modest job growth trends. At the time of this publication, current BLS employment and unemployment data were unavailable. As a result, updated unemployment rates and job growth figures for the Mpls-St Paul MSA, the State of Minnesota, and the United States are not reported for this quarter.

MARKET OVERVIEW:

The Mpls-St Paul industrial market consists of 300.4 msf in eight counties across the metro. Overall, there was 52,200 sf of positive absorption for Q2 2025, bringing the YTD to 1.0 msf positive absorption. Multi-tenant only properties posted (529,400) sf negative absorption bringing the YTD to 738,000 sf positive absorption. The overall vacancy rate for the quarter was 5.0% and multi- tenant properties vacancy rate was 7.5%. To date, there are 31 construction projects throughout the market totaling 3.7 msf and 13 properties have been delivered this year with 1.1 msf.

MARKET HIGHLIGHTS:

The Northwest market showed the lowest vacancy rate of 4.6% while the Southwest market is at the top with 8.2% for all properties. The Southeast market posted the most positive absorption with 201,000 sf led by Livchartor purchasing a 212,400 sf property. The Southwest market posted the most in negative absorption of (346,500) sf led by Value Vision Media vacating 139,200 sf. At the close of Q4 2025, the market experienced 2.7 msf of leasing activity in 211 transactions. Ninety five properties sold totaling 4.9 msf for $498.7 million.

MARKET MAP:

Image courtesy of Google maps.

Q4 2025 Industrial Market Report is created by Minnesota Commercial Real Estate Association. For more information, you can reach them at: www.mncar.org

Market Insight

Get access to all future Industrial Market Reports below

Industrial Market Experts

News & Updates

Q4 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ4 2025 Minneapolis-St. Paul Office Market Summary Q4 2025 Twin Cities Office Insights: Stabilization with Selectivity Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released...

Expert Q&A-How Companies Can Prepare For the Next Downturn

NEWS POSTQ&A-How Companies Can Prepare for the Next DownturnNavigating Real Estate in an Uncertain EconomyExpert Q & A with Forte Leadership-Jim Jetland, SIOR-principal; Steve Brown, CCIM-principal, Phil Simonet-principal, and Paul Donovan-COOForte’s...

Q2 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ2 2025 Minneapolis-St. Paul Office Market Summary Q2 2025 Twin Cities Office Insights: A Tale of Two Markets Forte’s Erik Nordstrom, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released by...