MARKET INSIGHT

Q4 2024 Minneapolis-St. Paul Office Market Summary

Vacancy continues to rise as businesses prioritize high-quality space but less of it

Forte’s Ericka Miller, Vice President-Real Estate Advisory, provides insight to the Twin Cities office market report recently released by MNCAR/REDI.

Rising Vacancy Rates

To nobody’s surprise, the Twin Cities continues to grapple with rising vacancy rates across all office asset classes, reaching 20% in Q4 2024, up from 17.1% in Q4 2023. This increase is indicative of broader trends affecting the commercial real estate sector, including shifts in work patterns and economic uncertainty.

Negative Absorption

The region experienced over 565,000 square feet of negative absorption in Q4 2024. This negative absorption reflects the net loss of leased space, as more companies downsize or vacate their office space as their lease expires. Consequently, some buildings are either reverting back to lending institutions or being sold at prices significantly below market value.

Flight to Quality

Despite the challenges, there is a notable “flight to quality” trend. Businesses are increasingly prioritizing high quality office spaces with superior amenities to attract employees back to the office. This trend has driven the recognition that an inviting and well-equipped workspace can enhance employee satisfaction and productivity. As a result, premium office buildings with modern amenities are seeing higher demand, even as overall space requirements decline.

Hottest Submarket

Not surprisingly, the most vibrant office submarkets in the Twin Cities are those that provide walkable amenities and a variety of restaurants and bars, catering to a younger workforce both during and after work hours. Notably, the North Loop and West End exemplify this trend. These areas are bustling with activity, offering numerous dining and entertainment options that attract young professionals. This combination of convenience and lifestyle appeal makes these submarkets particularly attractive for businesses looking to draw in and retain a dynamic, youthful workforce.

Outlook for 2025

Looking ahead, 2025 is expected to be another challenging year for the Twin Cities office market. High vacancy rates and negative absorption trends are likely to persist, although the flight to quality and hybrid work models may provide some stabilization. Additionally, minimal new office inventory is anticipated, which could help balance supply and demand. With newly elected leaders we will expect to see some changes in the market but whether they affect the office market positively remains to be seen.

Q4-2024 Minneapolis-St. Paul Office Market Summary

MARKET RECAP:

All Properties:

Total Inventory: 125,630,591 sf

Total # of Buildings: 1,036

Absorption: (566,456) sf

Vacancy: 20.0%

Asking Rate: $27.60 NNN

New Construction: 1,639,724 sf

Multi-Tenant Properties

Total Inventory: 87,792,136 sf

Total # of Buildings: 835

Absorption: (222,048) sf

Vacancy: 24.4%

Asking Rate: $27.60

ECONOMIC OVERVIEW:

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) increased 100 basis points to 2.9% for November 2024 from 1.9% for November 2023. The unemployment rate for the US was at 4.2% in November 2024 increasing 50 basis points from last year. State of Minnesota unemployment rate was 3.5%. The Mpls-St Paul MSA saw an decrease in job growth while office decreased in job growth in professional, financial and information with 22,800 during the same period.

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET OVERVIEW:

The Mpls-St Paul office market consists of 125.6 msf of space in seven metro counties. This region posted (566,400) sf of negative absorption for Q4 2024 and showed an overall vacancy rate of 20.0% for all properties. This quarter showed (597,000) sf of direct negative absorption and subleases accounted for 30,500 sf positive absorption. Multi-tenant only properties posted 24.4% vacancy with (222,000) sf negative absorption. During Q4 2024 there were eight construction projects throughout the market totaling 1.6 msf.

MARKET HIGHLIGHTS:

During Q4 2024, the market experienced over 815,700 sf of leasing activity in 227 transactions. The Mpls Northloop market was the only market to post direct positive absorption of 5,800 sf led by US Solar leasing 9,500 sf as The Southwest market posted the most in negative direct absorption of (359,400) sf due to United Health vacating 345,000 sf. The direct vacancy rate for class A properties have increased to 18.2% in Q4 2024 compared to 13.6% last year. Seventy five properties with 3.7 msf sold for $308 million this quarter.

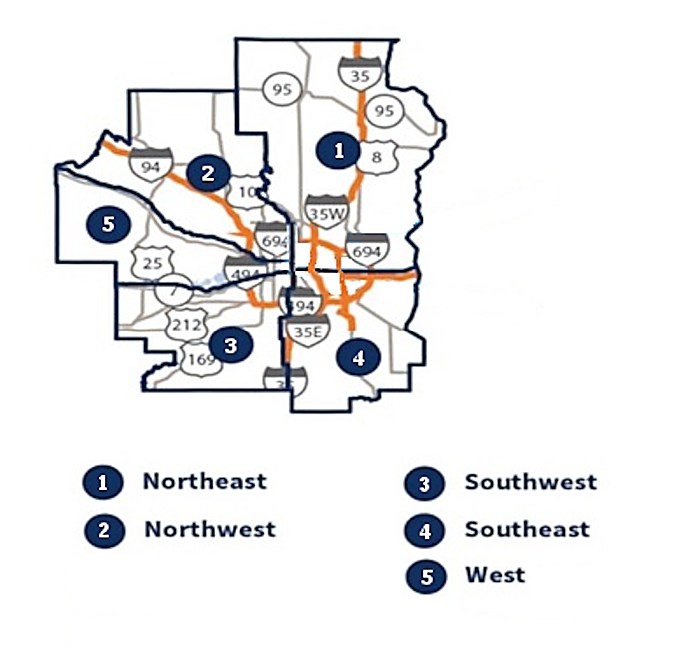

MARKET MAP:

Q4 2024 Office Market Report is created by Minnesota Commercial Real Estate Association. For more information, you can reach them at: www.mncar.org

Market Insight

Get access to all future Office Market Reports below

Office Market Experts

News & Updates

Expert Q&A-How Companies Can Prepare For the Next Downturn

NEWS POSTQ&A-How Companies Can Prepare for the Next DownturnNavigating Real Estate in an Uncertain EconomyExpert Q & A with Forte Leadership-Jim Jetland, SIOR-principal; Steve Brown, CCIM-principal, Phil Simonet-principal, and Paul Donovan-COOForte’s...

Q2 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ2 2025 Minneapolis-St. Paul Office Market Summary Q2 2025 Twin Cities Office Insights: A Tale of Two Markets Forte’s Erik Nordstrom, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released by...

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...