Q3-2022 Office Market Update

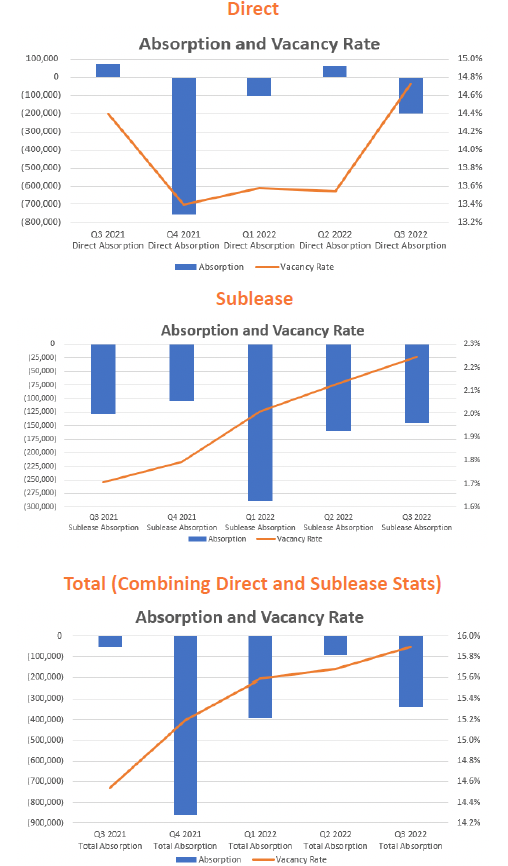

The Twin Cities Office Market continued a trend of negative absorption in all classes of space through the 3rd quarter, 2022. While there was less negative absorption in Q3 compared to Q2, the trend is expected to continue as companies search to find the right balance between employees working from the office, home, or a hybrid solution. It is expected that the market will see further consolidation in occupied space from Twin Cities corporate users. This will likely result in more sublease space being brought to the market raising the already high overall vacancy rate in the Twin Cities Office Market even higher.

ECONOMIC OVERVIEW:

MARKET OVERVIEW:

The Mpls-St Paul office market, consisting of 130 msf of space in seven counties across the metro saw (341,300) sf negative absorption for Q3 2022 and shows an overall vacancy rate of 15.9% for all properties. This quarter shows (198,600) sf of direct negative absorption while subleases accounted for (145,000) sf negative absorption. Multi-tenant only properties posted 20.8% vacancy with (221,800) sf negative absorption during Q3 2022 of which (79,000) sf negative absorption was for direct space and (145,000) sf negative absorption was for subleases. During Q3 2022 there were 15 construction projects throughout the market totaling just shy of 1.0 msf. Ten properties have been delivered YTD with 810,000 sf.

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET HIGHLIGHTS:

Office Advisory Experts

News

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...

Q1 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities industrial market enters 2025 with sustained momentum in absorption and decreasing vacancy By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities...

Q4 2024 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2024 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial market ends 2024 with strong occupancy but weak warehouse office absorption By: John Young, CCIM, Vice President - Real Estate Advisory The Twin Cities industrial market...