Q3-2021 Office Market Report

MARKET RECAP:

All Properties:

Total Inventory: 129,868,213 sf

Total # of Buildings: 1,032

Absorption: 49,836 sf

Vacancy: 14.5%

Asking Rate: $25.29 (full service gross)

Under Construction: 4,104,965 sf

Multi-tenant Properties:

Total Inventory: 92,464,377 sf

Total # of Buildings: 837

Absorption: 50,734 sf

Vacancy: 19%

Asking Rate: $25.30 (Full Service Gross)

ECONOMIC OVERVIEW:

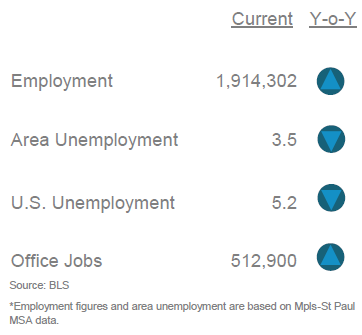

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) decreased 340 basis points to 3.5% for August 2021 from 6.9% for August 2020. The unemployment rate for the US was 5.2% in August 2021 down from 8.4% last year. State of Minnesota unemployment rate was 3.8%. The Mpls-St Paul MSA saw an increase in job growth as well as an increase in office job growth in professional, financial and information with 10,900 during the same period.

MARKET HIGHLIGHTS

During Q3 2021 the market experienced over 1.4 msf of leasing activity in 348 transactions. Year over Year Class A properties vacancy rate increased for all properties from 10.4% Q3 2020 to 13.8% Q3 2021. Multi-tenant class A properties also increased from 15.0% Q3 2020 to 19.6% Q3 2021. For multi-tenant properties the Mpls CBD vacancy was 22.8%, St Paul CBD was 16.6% and suburban markets was 16.9% as a lot of companies consolidated their space. Most of the absorption change was due to Deluxe leasing 94,000 sf in Mpls CBD. The Southwest market was hit with 72,000 sf negative absorption led by Dell Technology sublease of 31,000 sf.

EMPLOYMENT:

MARKET OVERVIEW:

The Mpls-St Paul office market, consisting of 129.8 msf of space in seven counties across the metro topping 49,000 sf positive absorption for Q3 2021. The vacancy rate for the market stands at 14.5% for all properties. Absorption for direct space excluding subleases was 178,500 sf positive absorption. Multi-tenant properties posted 19.0% vacancy with over 50,734 sf positive absorption during Q3 with direct space posting 148,000 sf positive absorption. During Q3 2021 there were 17 construction projects throughout the market totaling just over 1.123 msf.

Q3-2021 Office Market Report created by Minnesota Commercial Real Estate Association. For more information you can reach them at: www.mncar.org