MARKET INSIGHT

Q2 2025 Minneapolis-St. Paul Office Market Summary

Q2 2025 Twin Cities Office Insights: A Tale of Two Markets

Forte’s Erik Nordstrom, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released by MNCAR/REDI.

The Twin Cities office market is starting to show signs of recovery, with positive net absorption for the first time in over two years. But the story isn’t the same everywhere. Downtown Minneapolis continues to face challenges, while suburban areas are holding steady—or even thriving. This quarter highlights a shift in how and where companies want to work, with a clear preference for quality spaces, thoughtful design, and sustainable features that support evolving workplace strategies.

Contrasting Trends: Downtown Struggles, Suburban Stability

The Twin Cities office market posted positive net absorption in Q1 2025 for the first time since early 2022. However, Minneapolis’ core CBD continues to experience negative absorption, with tenants reducing footprints and the average new lease at just 15,056 sf. Notably, 65% of downtown leases signed this quarter were under 10,000 sf, underscoring the downsizing trend.

Leasing Activity & Vacancy Pressures

The “flight to quality” remains the market’s defining dynamic. Tenants are seeking out modern Class A space with strong amenity packages, even as overall space needs decline. Downtown landlords are offering competitive rates and concessions, yet vacancy in older Class B and C product remains elevated across all submarkets. In contrast, well-located suburban Class A properties with elevated amenities are achieving stabilized or even full occupancy, highlighting the split between core and suburban performance.

Smaller but Smarter: Redefining the Workplace

Office tenants are leasing smaller spaces but investing more per square foot to create curated, employee-focused environments. Buildouts increasingly emphasize collaboration zones, wellness integration, and brand expression as companies refine return-to-office strategies aimed at “earning the commute.”

Sustainability & Strategic Growth

Sustainability is becoming a key differentiator. Some tenants are drawn to properties that align with ESG commitments and help attract environmentally conscious employees. Owners investing in energy efficiency, wellness certifications, and modern design are positioning their assets for long-term success.

Major Transactions

Several transactions that concluded in Q2 2025 included 1500 Hwy 36 in Roseville ($13.4M), a 15-acre redevelopment slated for construction in the fall of 2026, it will be the Minnesota State Patrol’s new headquarters complete with office space, training facilities, and garage space for their fleet. Additionally, Dupont Office Center sold in Bloomington ($10.9M) and Arbor Lakes Medical Office Building sold in Maple Grove ($24.8M). These sales highlight investor appetite for medical and suburban office, as well as assets prime for redevelopment.

Key Takeaway

The Twin Cities office market is entering a new era—smaller, smarter, and more selective. As tenants focus on quality over quantity, landlords who deliver elevated workplace experiences will be best positioned to capture demand.

Q2-2025 Minneapolis-St. Paul Office Market Summary

MARKET RECAP:

All Properties:

Total Inventory: 124,865,850 sf

Total # of Buildings: 1,024

Absorption: (74,568 sf)

Vacancy: 20.0%

Asking Rate: $28.12 NNN

New Construction: 1,504,212 sf

Multi-Tenant Properties

Total Inventory: 87,142,659 sf

Total # of Buildings: 825

Absorption: 24,138 sf

Vacancy: 24.3%

Asking Rate: $28.11 NNN

ECONOMIC OVERVIEW:

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) increased 40 basis points to 3.1% for May 2025 from 2.7% for May 2024. The unemployment rate for the US was at 4.2% in May 2025 increasing 20 basis points from last year. State of Minnesota unemployment rate was 3.3%. The Mpls-St Paul MSA saw an increase in job growth but office decreased in job growth in professional, financial and information by 5,500 during the same period.

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET OVERVIEW:

The Mpls-St Paul office market consists of 124.8 msf of space in seven metro counties. This region posted (74,500) sf of negative absorption for Q2 2025 bringing YTD to 152,200 sf positive absorption and showed an overall vacancy rate of 20.0% for all properties. This quarter showed 85,700 sf of direct positive absorption and subleases accounted for (160,000) sf negative absorption. Multi-tenant only properties posted 24.3% vacancy with 24,100 sf positive absorption. During Q2 2025 there were eight construction projects throughout the market totaling 1.5 msf.

MARKET HIGHLIGHTS:

During Q2 2025, the market experienced over 1.3 msf of leasing activity in 377 transactions. The Southeast market posted direct positive absorption of 228,100 sf led by new delivery of Sick with 139,000 sf. The Northwest market posted the most in negative direct absorption of (157,400) sf due to Smith Medical downsizing 80,700 sf and Stanley vacating 40,000 sf. The direct vacancy rate for class A properties have increased to 17.8% in Q2 2025 compared to 16.6% last year for all properties. Eighty two properties with 1.4 msf sold for $151.7 million this quarter.

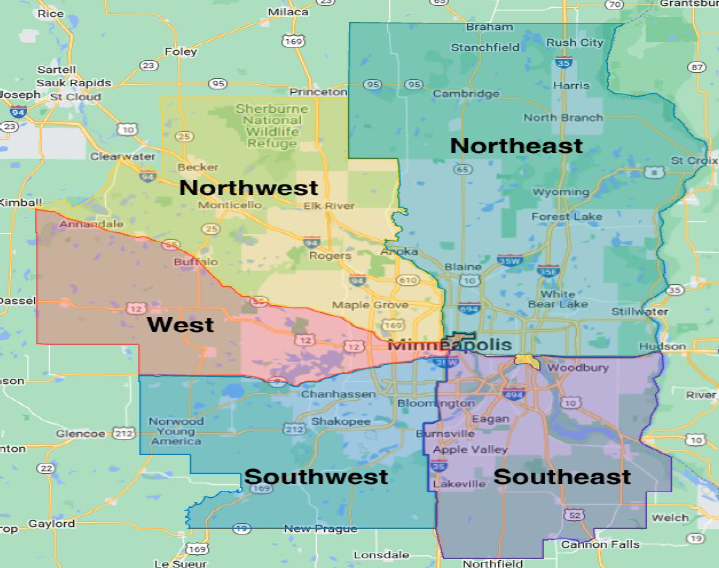

MARKET MAP:

Image courtesy of Google maps.

Q2 2025 Office Market Report is created by Minnesota Commercial Real Estate Association. For more information, you can reach them at: www.mncar.org

Market Insight

Get access to all future Office Market Reports below.

Office Market Experts

News & Updates

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...

Q1 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities industrial market enters 2025 with sustained momentum in absorption and decreasing vacancy By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities...

Q4 2024 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2024 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial market ends 2024 with strong occupancy but weak warehouse office absorption By: John Young, CCIM, Vice President - Real Estate Advisory The Twin Cities industrial market...