MARKET INSIGHT

Q2 2025 Minneapolis-St. Paul Industrial Market Summary

Twin Cities industrial market maintains stability with modest absorption and steady vacancy

By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities industrial market report provided by MNCAR/REDI.

The Twin Cities industrial market continued to show resilience through the first half of 2025, though momentum has moderated compared to the record-setting pace of prior years. The metro now comprises 300.4 msf of industrial space, ending Q2 with a 5.0% overall vacancy rate. Net absorption for the quarter registered at 52,200 sf, bringing year-to-date absorption to 1.0 msf.

While multi-tenant properties struggled, posting (529,400) sf of negative absorption and a 7.5% vacancy, the broader market was buoyed by single-tenant activity. Leasing volume reached 1.7 msf across 194 transactions, while investment sales remained strong with 95 properties totaling 4.3 msf sold for $464.3 million.

Submarket Performance

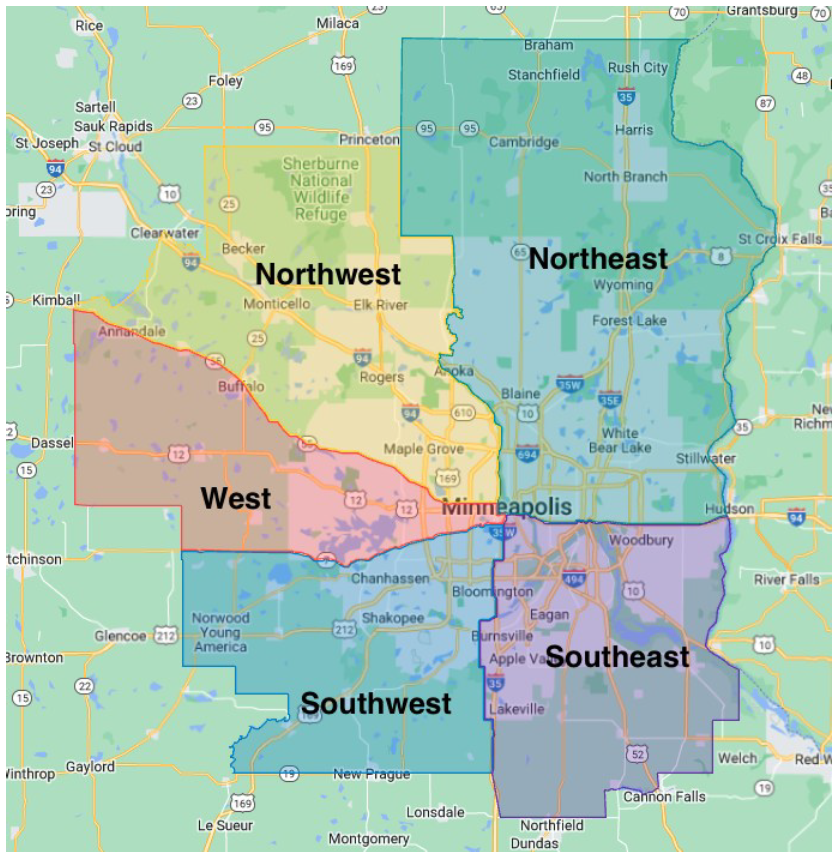

- Northeast: Strongest performer with 256,000 sf positive absorption, vacancy at 3.3%, the lowest in the metro.

- Southeast: Added 270,000 sf of absorption, led by Niagara Bottling’s 424,000 sf build-to-suit delivery.

- Southwest: Continued to struggle with (215,000) sf of negative absorption and the metro’s highest vacancy at 7.6%.

- West: Posted the sharpest decline, with (309,000) sf of negative absorption, driven by large sublease vacancies.

- Northwest: Modest growth with 50,000 sf positive absorption, supported by bulk warehouse leasing.

Development

The pipeline remains active but increasingly tenant driven. 31 projects totaling 3.7 msf are under construction, with build-to-suit projects accounting for most of the activity. Year-to-date, 1.1 msf has been delivered, concentrated in the Northwest and Southeast submarkets. The historically conservative speculative development approach of the Twin Cities remains evident relative to other U.S. markets.

Economic & Employment Context

The MSP metro unemployment rate rose slightly to 3.1% (up 40 basis points year-over-year), though industrial-related employment remained strong, with manufacturing jobs adding 3,600 positions over the past year.

- Market Dynamics Rents: Asking rates continue to trend upward, ranging from $8.45–$11.29 NNN across property types, with flex and R&D space commanding the highest premiums.

- Investor Activity: Nearly $465M in sales volume during Q2 underscores continued capital confidence in the industrial sector despite macroeconomic headwinds.

- Tenant Landscape: With vacancy compressed in several submarkets and limited new speculative supply, tenants face a competitive environment, particularly for modern distribution facilities.

Outlook

Despite global uncertainties—including tariffs, interest rate volatility and the continuing disfunction in Washington DC—the Twin Cities industrial market remains stable and cautiously optimistic. Resilient demand limited speculative development, and a diversified tenant base continue to uphold fundamentals. Looking ahead, rent growth is expected to persist, while tenants seeking large blocks of space may encounter constrained options and rising costs.

Q2-2025 Minneapolis-St. Paul Industrial Market Summary

MARKET RECAP:

All Properties:

Total Inventory: 300,411,225 sf

Total # of Buildings: 3,360

Absorption: 52,205 sf

Vacancy: 5.0%

Asking Rate Low: $8.45 NNN

Asking Rate High: $11.29 NNN

Under Construction: 3,735,215 sf

Multi-Tenant Properties

Total Inventory: 154,598,751 sf

Total # of Buildings: 1,853

Absorption: (529,394) sf

Vacancy: 7.5%

Asking Rate Low: $8.53

Asking Rate High: $11.30

ECONOMIC OVERVIEW:

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) increased 40 basis points to 3.1% for May 2025 from 2.7% for May 2024. The unemployment rate for the US was at 4.2% in May 2025 increasing 20 basis points from last year. State of Minnesota unemployment rate was 3.3%. The Mpls-St Paul MSA saw an increase in job growth while industrial specific jobs increased in job growth in manufacturing by 3,600 during the same period.

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET OVERVIEW:

The Mpls-St Paul industrial market consists of 300.4 msf in eight counties across the metro. Overall, there was 52,200 sf of positive absorption for Q2 2025, bringing the YTD to 1.0 msf positive absorption. Multi-tenant only properties posted (529,400) sf negative absorption bringing the YTD to 738,000 sf positive absorption. The overall vacancy rate for the quarter was 5.0% and multi- tenant properties vacancy rate was 7.5%. To date, there are 31 construction projects throughout the market totaling 3.7 msf and 13 properties have been delivered this year with 1.1 msf.

MARKET HIGHLIGHTS:

The Northeast market showed the lowest vacancy rate of 3.3% while the Southwest market is at the top with 7.6% for all properties. The Southeast bested all markets with 270,000 sf positive absorption led by the new delivery of 424,300 sf to Niagara Bottling. The West market posted the most in negative absorption of (309,400) sf led by Beyer Distribution vacating 203,000 sf on a sublease. At the close of Q2 2025, the market experienced 1.7 msf of leasing activity in 194 transactions. Ninety five properties sold totaling 4.3 msf for $464.3 million.

MARKET MAP:

Image courtesy of Google maps.

Q2 2025 Industrial Market Report is created by Minnesota Commercial Real Estate Association. For more information, you can reach them at: www.mncar.org

Market Insight

Get access to all future Industrial Market Reports below

Industrial Market Experts

News & Updates

Q4 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ4 2025 Minneapolis-St. Paul Office Market Summary Q4 2025 Twin Cities Office Insights: Stabilization with Selectivity Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released...

Q4 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial Market Holds Firm Despite Late-Year Softness By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities industrial market report provided by...

Expert Q&A-How Companies Can Prepare For the Next Downturn

NEWS POSTQ&A-How Companies Can Prepare for the Next DownturnNavigating Real Estate in an Uncertain EconomyExpert Q & A with Forte Leadership-Jim Jetland, SIOR-principal; Steve Brown, CCIM-principal, Phil Simonet-principal, and Paul Donovan-COOForte’s...