MARKET INSIGHT

Q2 2024 Minneapolis-St. Paul Office Market Summary

Forte’s Ericka Miller, Vice President Real Estate Advisory, provides insight to the Twin Cities office market report recently released by MNCAR/REDI.

Low unemployment rates can often align with a strong office market, but the Twin Cities office market continues to experience negative office absorption despite the strong employment numbers. In Q2, the Twin Cities overall unemployment rate dropped to 2.6% while growth in “typical” office jobs decreased during the same period.

Office vacancies are rising, with overall market vacancy coming in at 18.3% and multi-tenant office properties at 22.6%. The bright spot continues to be the West market, showing a positive absorption of 31,300 square feet in Q2.

All eyes are on the Federal Reserve’s September report– as many owners are suffering from the combination of increasing vacancy rates, high interest rates and a labor shortage. A rate cut would be a welcome reprieve. Despite the high vacancy rates, it isn’t generally a slam dunk for tenants, as owners are maintaining rental rates to preserve their investment value.

Q2-2024 Minneapolis-St. Paul Office Market Summary

MARKET RECAP:

All Properties:

Total Inventory: 126,757,500 sf

Total # of Buildings: 1,037

Absorption: (634,165) sf

Vacancy: 18.3%

Asking Rate: $27.25 NNN

New Construction: 1,375,466 sf

Multi-Tenant Properties

Total Inventory: 87,815,199 sf

Total # of Buildings: 836

Absorption: (382,422) sf

Vacancy: 22.8%

Asking Rate: $27.26

ECONOMIC OVERVIEW:

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) decreased 30 basis points to 2.6% for May 2024 from 2.9% for May 2023. The unemployment rate for the US was at 4.0% in May 2024 increasing 30 basis points from last year. State of Minnesota unemployment rate was 2.8%. The Mpls-St Paul MSA saw an decrease in job growth while office decreased in job growth in professional, financial and information with 21,100 during the same period.

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET OVERVIEW:

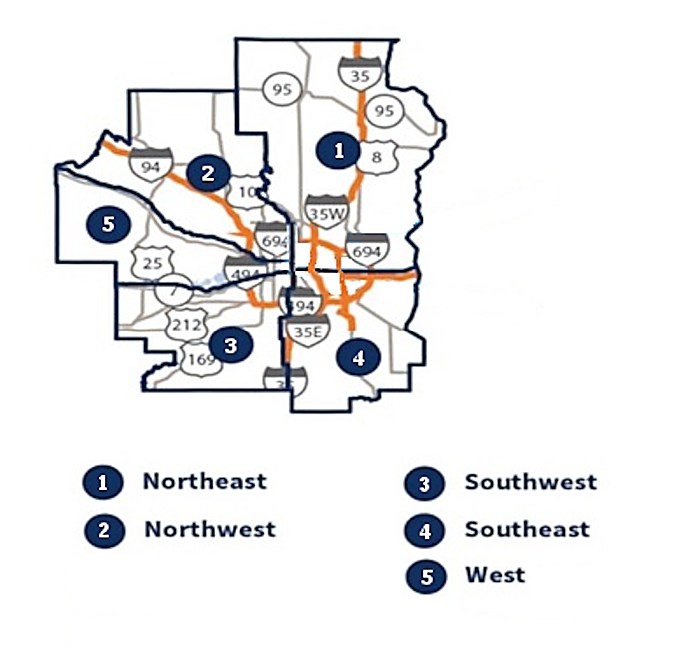

The Mpls-St Paul office market consists of 126.7 msf of space in seven metro counties. This region posted (634,100) sf of negative absorption for Q2 2024 and showed an overall vacancy rate of 18.3% for all properties. This quarter showed (551,500) sf of direct negative absorption and subleases accounted for (82,500) sf negative absorption. Multi-tenant only properties posted 22.6% vacancy with (382,400) sf negative absorption. During Q2 2024 there were 6 construction projects throughout the market totaling 1.3 msf.

MARKET HIGHLIGHTS:

During Q2 2024, the market experienced over 1.0 msf of leasing activity in 299 transactions. For direct leasing, Mpls CBD markets posted (114,600) sf negative absorption. The suburban markets posted (437,300) sf. St Paul CBD posted 300 sf positive absorption. The West market had the most direct positive absorption of 31,300 sf. The Southeast market posted the most in negative absorption of (446,000) sf due to US Bank vacating 329,800 sf. The largest positive absorption was Brown & Brown leasing 42,800 sf in Mpls CBD Core market. Fifty three properties with 1.2 msf sold for $151.9 million this quarter.

MARKET MAP:

Q2 2024 Office Market Report is created by Minnesota Commercial Real Estate Association. For more information, you can reach them at: www.mncar.org

Market Insight

Get access to all future Office Market Reports below

Office Market Experts

News & Updates

Q4 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ4 2025 Minneapolis-St. Paul Office Market Summary Q4 2025 Twin Cities Office Insights: Stabilization with Selectivity Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released...

Q4 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial Market Holds Firm Despite Late-Year Softness By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities industrial market report provided by...

Expert Q&A-How Companies Can Prepare For the Next Downturn

NEWS POSTQ&A-How Companies Can Prepare for the Next DownturnNavigating Real Estate in an Uncertain EconomyExpert Q & A with Forte Leadership-Jim Jetland, SIOR-principal; Steve Brown, CCIM-principal, Phil Simonet-principal, and Paul Donovan-COOForte’s...