MARKET INSIGHT POST

Q2-2023 Minneapolis-St. Paul Industrial Market Update

Q2-2023 Minneapolis-St. Paul Industrial Market Update

MARKET RECAP:

ECONOMIC OVERVIEW:

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

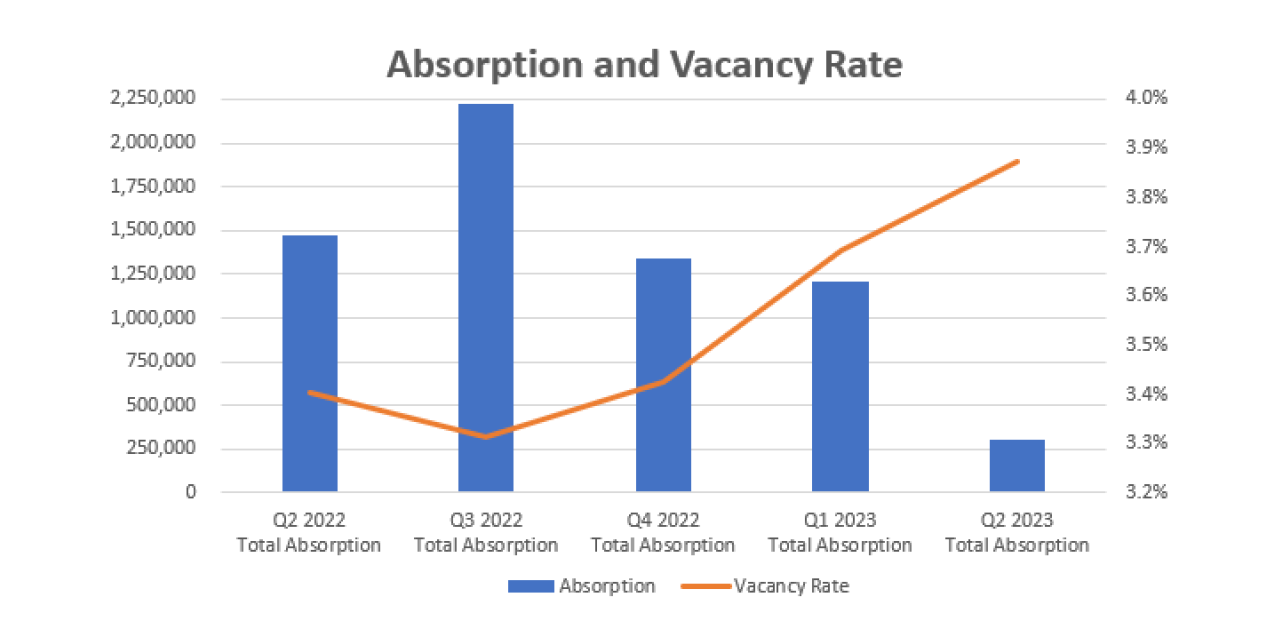

MARKET OVERVIEW:

MARKET HIGHLIGHTS:

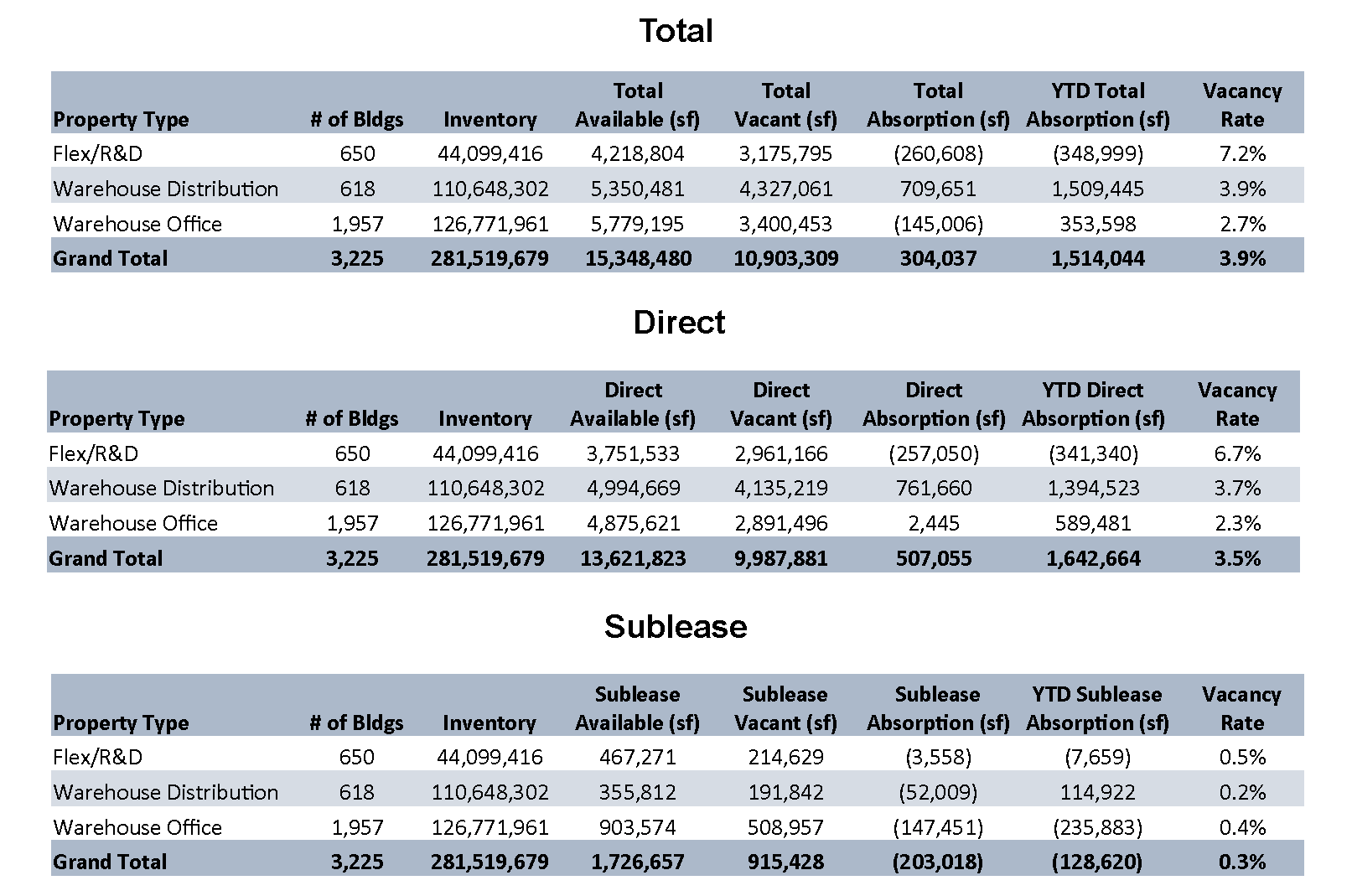

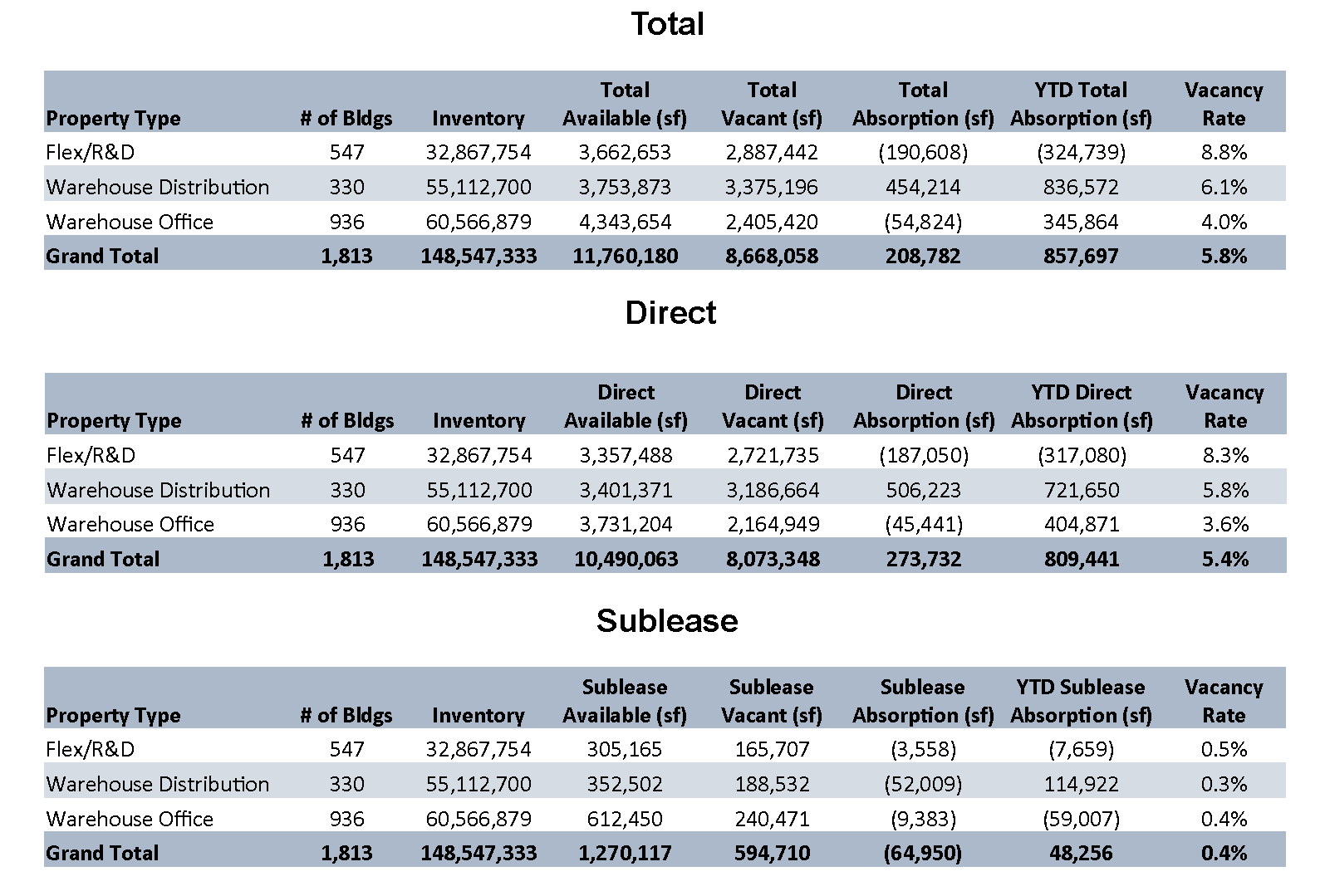

MARKET STATISTICS BY PROPERTY TYPE

Multi and Single Tenant:

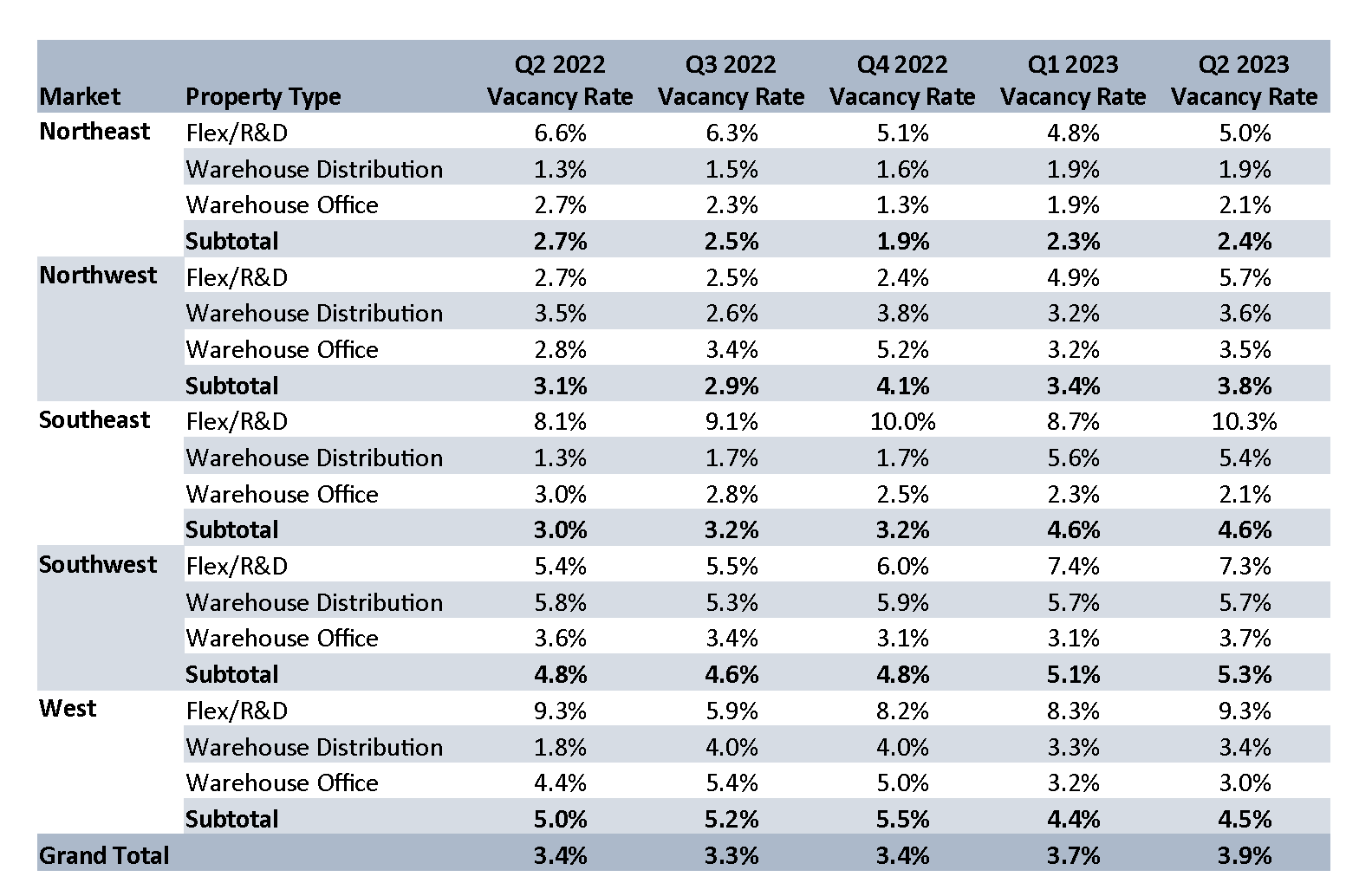

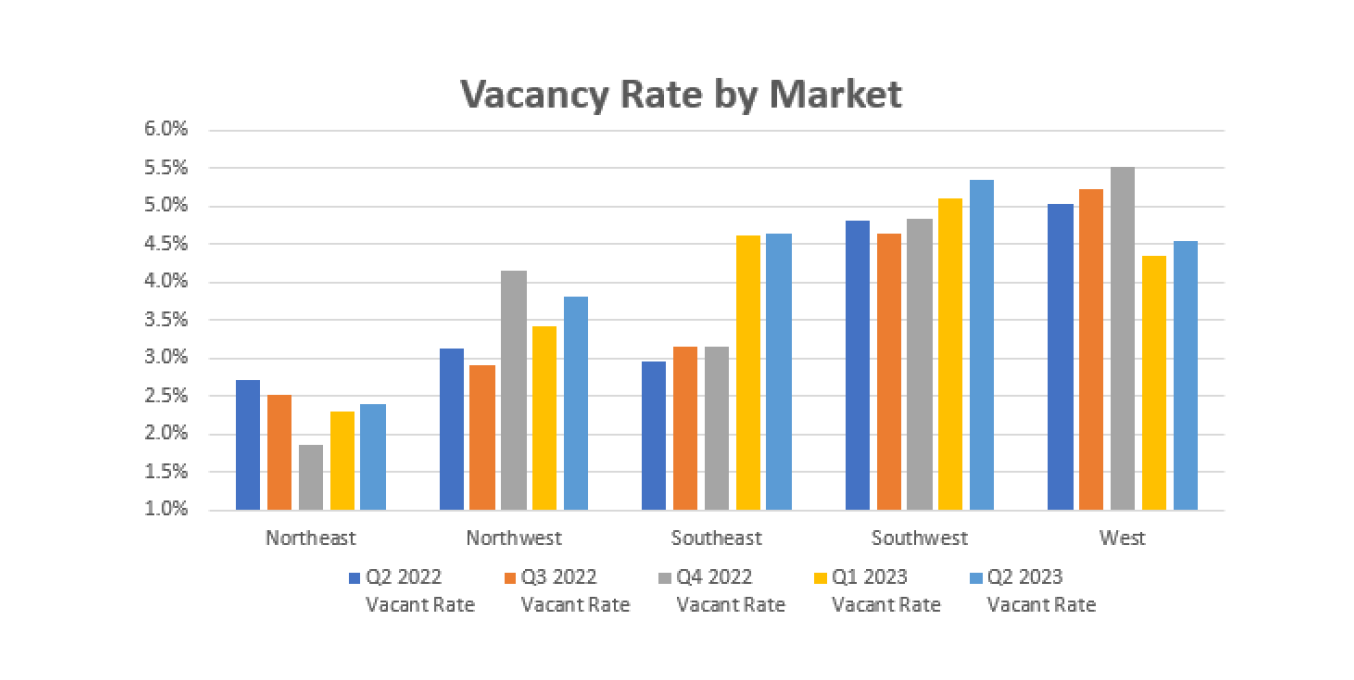

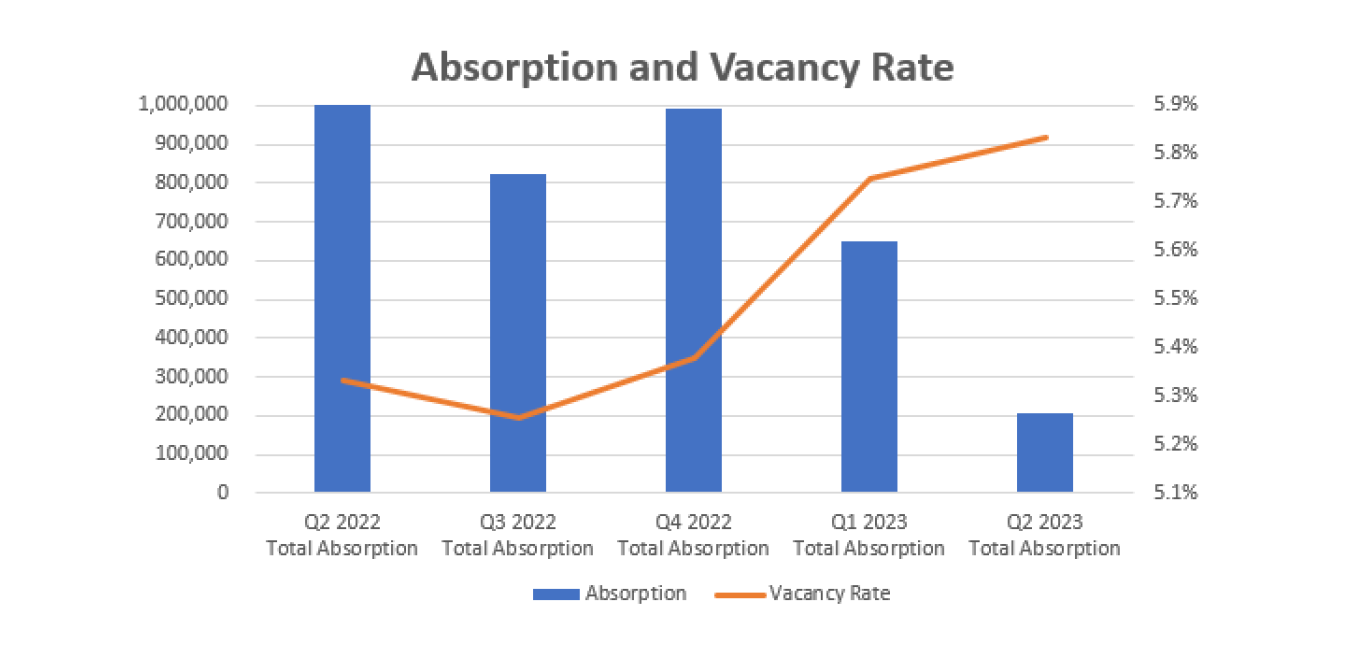

VACANCY RATES BY MARKET

Multi and Single Tenant:

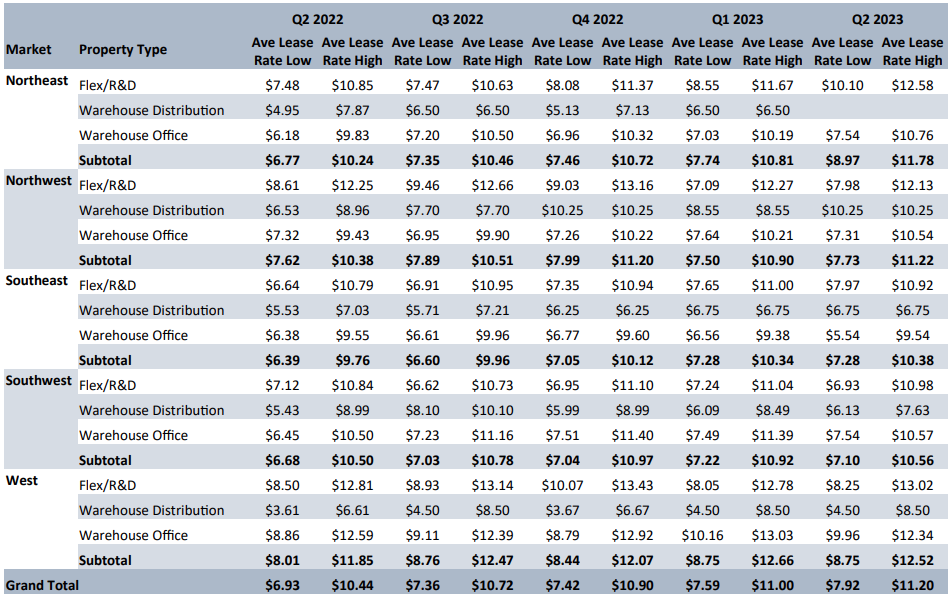

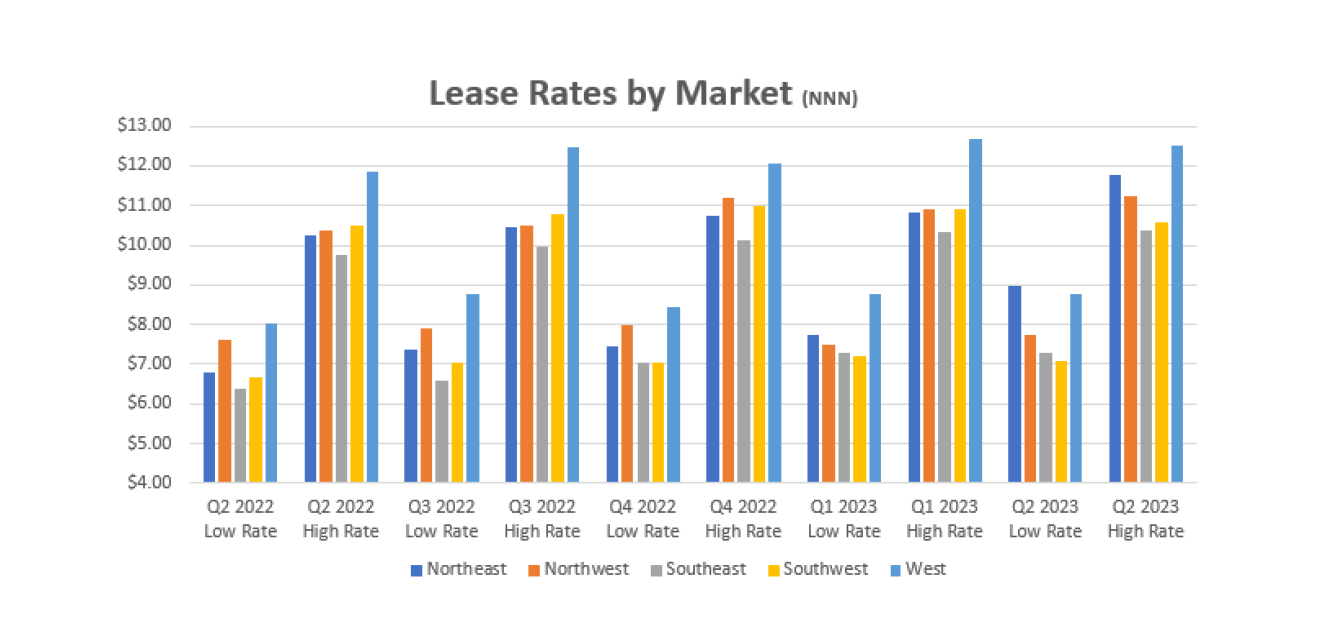

LEASE RATES BY MARKET

Multi and Single Tenant NNN:

MARKET STATISTICS BY PROPERTY TYPE

Multi Tenant:

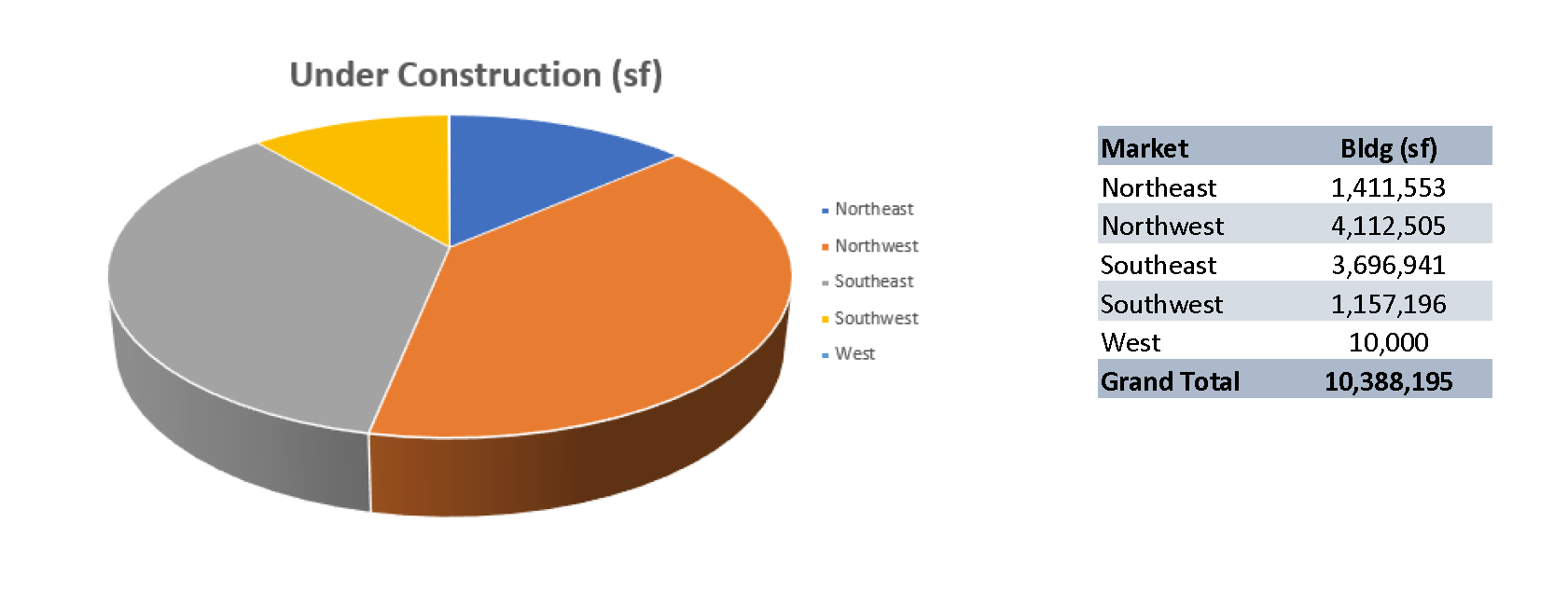

NEW DEVELOPMENTS BY MARKET:

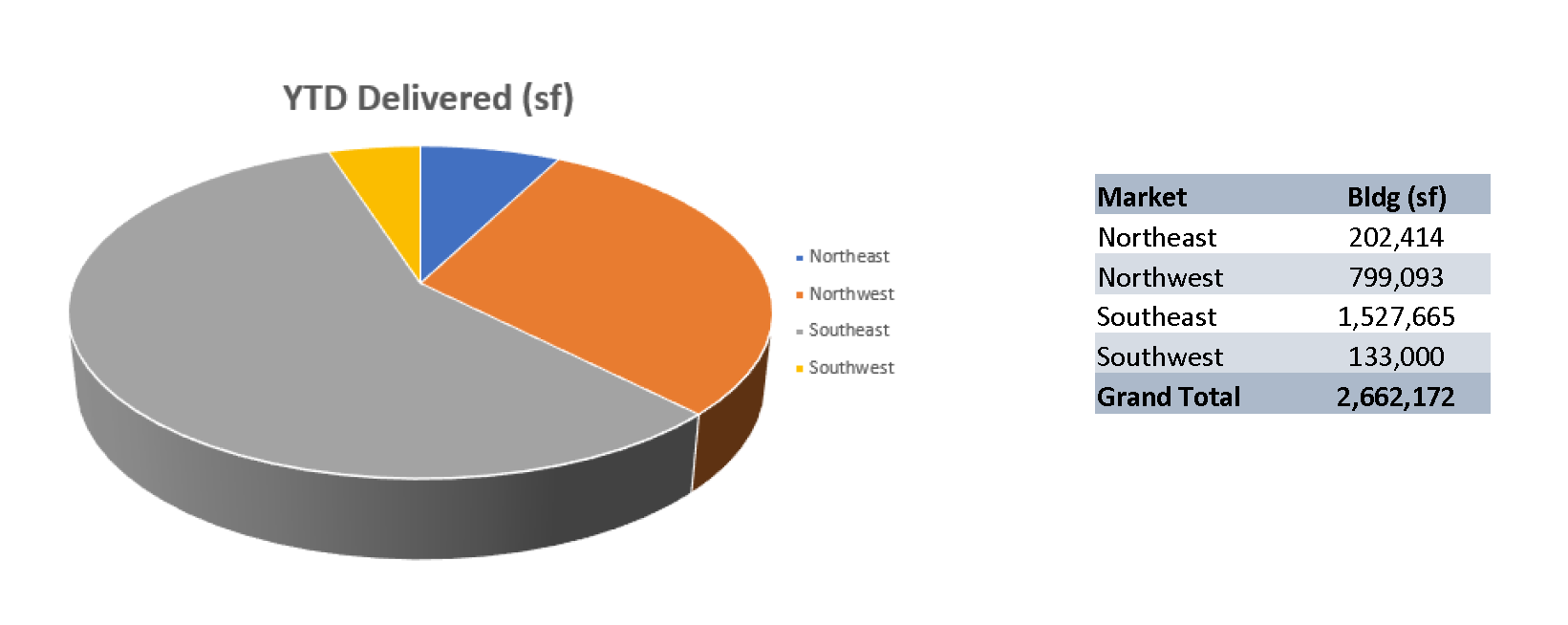

YEAR-TO-DATE DELIVERIES BY MARKET:

Market Insight

Industrial Market Experts

News & Updates

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...

Q1 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities industrial market enters 2025 with sustained momentum in absorption and decreasing vacancy By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities...

Q4 2024 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2024 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial market ends 2024 with strong occupancy but weak warehouse office absorption By: John Young, CCIM, Vice President - Real Estate Advisory The Twin Cities industrial market...