MARKET INSIGHT

Q1 2025 Minneapolis-St. Paul Office Market Summary

Future of Twin Cities Office Space: Smaller, Smarter, and Sustainable

Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released by MNCAR/REDI.

Contrasting Trends: Downtown Struggles and Suburban Stability

The good news from Q1 2025: the Twin Cities office market posted positive net absorption for the first time since Q1 2022. However, the Minneapolis core CBD continued to experience negative absorption, largely driven by tenants reducing their footprint. The average lease size in downtown Minneapolis was 15,056 square feet (sf), with 65% of signed leases under 10,000 sf.

The “flight to quality” trend remains a dominant factor as companies refine their return-to-office strategies aimed at “earning the commute.” Demand is strongest for premium Class A buildings—both downtown and in the suburbs—that offer modern amenities, even as overall space needs shrink.

Navigating the Twin Cities Office Market: Challenges and Innovations

The Twin Cities office market remains a story of contrasting submarkets. While many organizations still value a downtown presence, reactivating the core CBD will remain challenging—even with competitive lease rates and generous concessions from landlords. In contrast, suburban Class A owners investing in amenitized environments continue to attract tenants, often reaching stabilized or full occupancy.

Looking ahead, most office tenants will be smaller—but smarter. Companies are leasing less square footage, but investing more per square foot to elevate the employee experience. Spaces are increasingly curated for intentional collaboration, wellness, and brand expression.

Buildings that align with sustainability goals and corporate social responsibility are gaining favor among tenants looking to attract environmentally conscious employees and stakeholders. Landlords and tenants alike are becoming more strategic about long-term growth and workplace design—signaling a shift toward quality over quantity in office real estate.

Q1-2025 Minneapolis-St. Paul Office Market Summary

MARKET RECAP:

All Properties:

Total Inventory: 124,937,420 sf

Total # of Buildings: 1,028

Absorption: 253,700 sf

Vacancy: 19.9%

Asking Rate: $27.83 NNN

New Construction: 1,703,636 sf

Multi-Tenant Properties

Total Inventory: 87,485,848 sf

Total # of Buildings: 830

Absorption: 139,600 sf

Vacancy: 24.3%

Asking Rate: $27.80 NNN

ECONOMIC OVERVIEW:

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) increased 20 basis points to 3.5% for February 2025 from 3.3% for February 2024. The unemployment rate for the US was at 4.1% in February 2025 increasing 20 basis points from last year. State of Minnesota unemployment rate was 3.0%. The Mpls-St Paul MSA saw an increase in job growth while office decreased in job growth in professional, financial and information with 4,500 during the same period.

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET OVERVIEW:

The Mpls-St Paul office market consists of 124.9 msf of space in seven metro counties. This region posted 253,700 sf of positive absorption for Q1 2025 and showed an overall vacancy rate of 19.9% for all properties. This quarter showed 259,300 sf of direct positive absorption and subleases accounted for (5,600) sf negative absorption. Multi-tenant only properties posted 24.3% vacancy with 139,600 sf positive absorption. During Q1 2025 there were ten construction projects throughout the market totaling 1.7 msf.

MARKET HIGHLIGHTS:

During Q1 2025, the market experienced over 1.3 msf of leasing activity in 337 transactions. The Southwest market posted direct positive absorption of 130,700 sf led by Stratasys leasing 165,000 sf. The Mpls CBD Core market

posted the most in negative direct absorption of (134,100) sf due to RBC vacating 36,500 sf and Stinson downsizing 33,700 sf. The direct vacancy rate for class A properties have increased to 18.2% in Q1 2025 compared to 15.3% last year for all properties. FSG lease rates have increased to $27.83 compared to $27.08 last year. Sixty properties with 2.0 msf sold for $99.3 million this quarter.

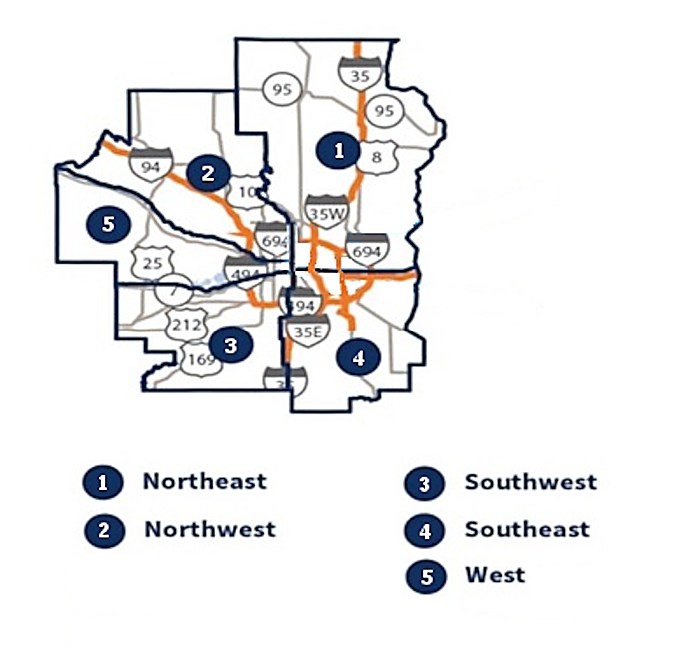

MARKET MAP:

Q1 2025 Office Market Report is created by Minnesota Commercial Real Estate Association. For more information, you can reach them at: www.mncar.org

Market Insight

Get access to all future Office Market Reports below.

Office Market Experts

News & Updates

Q4 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ4 2025 Minneapolis-St. Paul Office Market Summary Q4 2025 Twin Cities Office Insights: Stabilization with Selectivity Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently released...

Q4 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ4 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities Industrial Market Holds Firm Despite Late-Year Softness By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities industrial market report provided by...

Expert Q&A-How Companies Can Prepare For the Next Downturn

NEWS POSTQ&A-How Companies Can Prepare for the Next DownturnNavigating Real Estate in an Uncertain EconomyExpert Q & A with Forte Leadership-Jim Jetland, SIOR-principal; Steve Brown, CCIM-principal, Phil Simonet-principal, and Paul Donovan-COOForte’s...