MARKET RECAP:

All Properties:

Total Inventory: 129,892,693 sf

Total # of Buildings: 1,035

Absorption: (379,819) sf

Vacancy: 15.4%

Asking Rate: $25.74 (full service gross)

New Construction: 1,071,160 sf

Multi-tenant Properties:

Total Inventory: 93,596,205 sf

Total # of Buildings: 847

Absorption: (371,898) sf

Vacancy: 20.1%

Asking Rate: $25.74 (Full Service Gross)

ECONOMIC OVERVIEW:

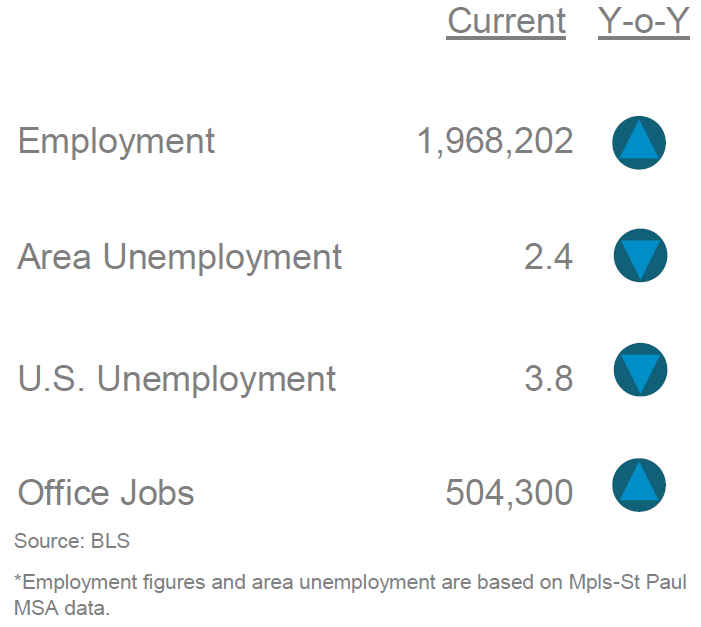

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) decreased 220 basis points to 2.4% for February 2022 from 4.6% for February 2021. The unemployment rate for the US was 3.8% in February 2022 down from 6.2% last year. State of Minnesota unemployment rate was 2.7%. The Mpls-St Paul MSA saw an increase in job growth as well as an increase in office job growth in professional, financial and information with 1,700 during the same period.

MARKET HIGHLIGHTS

During Q1 2022 the market experienced over 1.4 msf of leasing activity in 344 transactions. Year over Year the vacancy rate for multi-tenant Class A properties has increased from 15.4% Q1 2021 to 17.0% Q1 2022. Most of the negative absorption change was due to vacated sublease spaces by Comcast with 85,000 sf, Be The Match vacating 70,000 sf and Pearson vacating 64,000 sf. RBC increased their Mpls CBD Core footprint by 25% when they leased 345,000 sf in the new RBC Gateway building.

EMPLOYMENT:

MARKET OVERVIEW:

The Mpls-St Paul office market, consisting of 129.8 msf of space in seven counties across the metro saw (379,800) sf negative absorption for Q1 2022 and shows an overall vacancy rate of 15.4% for all properties. Subleases accounted for most of the change with (293,680) sf negative absorption. Multi-tenant only properties posted 20.1% vacancy with (372,898) sf negative absorption during Q1 2022 of which (149,468) sf negative absorption was for direct space and (223,430) sf negative absorption was for subleases. During Q1 2022 there were 22 construction projects throughout the market totaling just over 1.0 msf. The RBC Gateway with 550,000 sf of office was the only delivery this quarter.

Q1-2022 Minneapolis-St. Paul Office Market Report created by Minnesota Commercial Real Estate Association. For more information you can reach them at: www.mncar.org