MARKET RECAP:

All Properties:

Total Inventory: 268,507,876 sf

Total # of Buildings: 3,090

Absorption: 1,122,154 sf

Vacancy: 3.9%

Asking Rate Low: $6.73 NNN

Asking Rate High: $10.25 NNN

Under Construction: 4,825,218 sf

Multi-tenant Properties

Total Inventory: 140,752,641 sf

Total # of Buildings: 1,735

Absorption: 1,053,928

Vacancy: 5.8%

Asking Rate Low: $6.72

Asking Rate High: $10.25

ECONOMIC OVERVIEW:

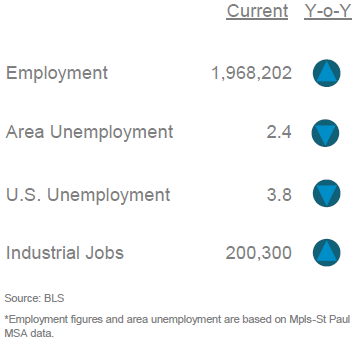

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) decreased 220 basis points to 2.4% for February 2022 from 4.6% for February 2021. The unemployment rate for the US was 3.8% in February 2022 down from 6.2% last year. State of Minnesota unemployment rate was 2.7%. The Mpls-St Paul MSA saw an increase in job growth as well as an increase industrial job growth in manufacturing with 9,200 during the same period.

MARKET HIGHLIGHTS

At the close of Q1 2022, the market experienced over 3.0 msf of leasing activity in 224 transactions with Owens & Minor leasing the largest space of 171,000 sf in the Northeast market. The Southeast market shows the lowest vacancy rate of 3.3% while the Southwest market is at the top with 5.1%. The Northwest market tops all markets with 564,000 sf positive absorption led by KSP Fulfillment leasing 221,000 sf. The West market shows (140,000) sf negative absorption led by Value Merchandise vacating 51,000 sf. Fifty six properties sold totaling just shy of 2.7 msf for $268 million.

EMPLOYMENT:

MARKET OVERVIEW:

The Mpls-St Paul industrial market consists of 268 msf in eight counties across the metro. There was over 1.1 msf of positive absorption overall for Q1 2022 while multi-tenant only properties posted 1.0 msf positive absorption. The overall vacancy rate for the market stands at 3.9% and multi-tenant vacancy dropped to 5.8% for Q1 2022. To date, there are 33 construction projects throughout the market totaling 4.8 msf and 9 properties were delivered this quarter with 1.5 msf.

Q1-2022 Industrial Market Report created by Minnesota Commercial Real Estate Association. For more information you can reach them at: www.mncar.org