2021-Q1 Industrial Market Report

MARKET OVERVIEW:

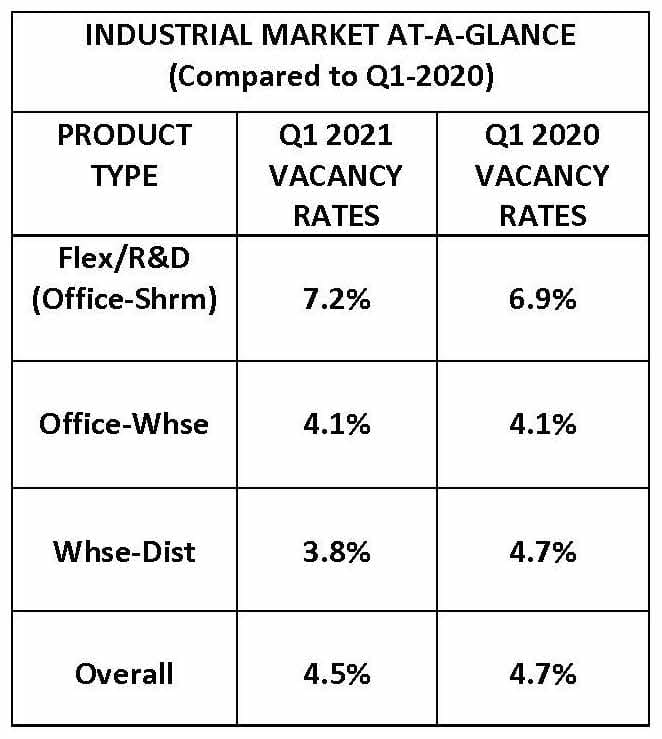

It’s no secret to anyone that COVID-19 had a significant impact on commercial real estate in 2020. It will continue to influence this asset class well into 2021. The impact was both good and bad, depending on what segment of the market one looks at. Clearly the retail and office markets suffered significantly with negative absorption, lack of activity and increasing vacancy rates. Industri-al real estate, on the other hand experienced a 60-90 day pause. Then came roaring back during the end of the Q3 and all of the Q4. Q1 2021 continues the robust market activity from Q4 with no ending in sight. Q1 2021 experienced net absorption of 1.26 million square feet and was led by high-bay warehouse distribution space which totaled net absorption alone of 825,591 square feet. Office warehouse was a distance second with 337,333 square feet of net absorption. Flex/R&D, as usual was the weakest segment of the industrial market with net absorption of 101,911 square feet. The aggre-gate market vacancy rate at the end of Q1 was a low 4.5%. In comparison, Q1 2020 net absorption was a weak 223,024 square feet however the vacancy rate was only 4.7%. While 2020 ended on a strong note with 1.40 million square feet of net absorption the previous three quarters of 2020 totaled an additional quarters of 2020 totaled an additional 1.20 million square feet. That was the result of a weak Q1 (223,024 SF) and thereafter the pause caused by Covid-19 (198,000 SF Q2-2020 and 780,000 SF Q3-2020).

OBSERVATIONS:

- Even with Covid-19, the industrial market has demonstrated remarkable stability. 2021 appears to be well-positioned for another stellar year of activity and corresponding statistics given the low vacancy rates, strong net absorption (1.00 million more square feet more than Q1 2020.)

- Sales activity and corresponding values have increased throughout the year. Low interest rates, a lack of available quali-ty product and many well qualified buyers (users) have produced high industrial values. These values are approaching $100.00 psf on well located, functional properties.

- Demand for goods and services will likely continue to increase during the balance of 2021. As long as unemployment rates con-tinue to decline and consumer confidence remains or increases, consumption will drive the recovery. The positive economic impact of mass vaccinations combined with the stimulus checks (disposable income) and higher savings rates should provide strong economic growth. Therefore, more demand for industrial space. Last Mile Home delivery (home delivery of internet or-dered goods) has been one of the largest beneficiaries of changing consumer habits. It is likely to remain, if not increase signifi-cantly in the future. Urban locations will see new demand for distribution space AND users/occupiers will be willing to pay the high net rates required for well-located warehouse/distribution space.