MARKET INSIGHT

Q4 2024 Minneapolis-St. Paul Industrial Market Summary

Twin Cities Industrial market ends 2024 with strong occupancy but weak warehouse office absorption

By: John Young, CCIM, Vice President – Real Estate Advisory

The Twin Cities industrial market demonstrated resilience in 2024, despite some moderation compared to the previous year. The market, comprising 298 million square feet of industrial space, ended the year with a vacancy rate of 5.2%, following a strong fourth quarter that saw 1.3 million square feet of absorption. Total absorption for 2024 reached 3.2 million square feet, which, while robust, fell short of 2023’s performance by over 1 million square feet. The bulk warehouse sector, characterized by properties with 32′ clear height and above, led the market with just over 3 million square feet of absorption.

Submarket Performance

The northwest and southeast submarkets were the primary drivers of absorption:

-

-

- Northwest: 1.5 million square feet

- Southeast: 1.6 million square feet

-

These areas accounted for most of the year’s absorption, highlighting their continued appeal to industrial tenants.

Property Type Trends

While the bulk warehouse sector thrived, the warehouse office sector experienced a significant slowdown:

-

-

- Bulk Warehouse: Over 3 million square feet absorbed

- Warehouse Office: Only 25,000 square feet absorbed (compared to 670,000 square feet in 2023)

-

The dramatic decrease in warehouse office absorption is attributed to supply constraints rather than diminished demand.

The industrial market in the Twin Cities remains strong, with low vacancy rates and continued absorption, albeit at a more moderate pace than in previous years. The potential stabilization of lease rates could provide some relief for tenants, but the market’s future trajectory in 2025 remains to be seen. One trend that is expected to continue is bringing manufacturing closer to home or back to the United States. This is driven by factors such as trade tensions and supply chain reorganization.

Q4-2024 Minneapolis-St. Paul Industrial Market Summary

MARKET RECAP:

All Properties:

Total Inventory: 298,257,898 sf

Total # of Buildings: 3,338

Absorption: 1,362,877 sf

Vacancy: 5.2%

Asking Rate Low: $8.35 NNN

Asking Rate High: $11.10 NNN

Under Construction: 3,009,469 sf

Multi-Tenant Properties

Total Inventory: 153,756,980 sf

Total # of Buildings: 1,842

Absorption: 351,423 sf

Vacancy: 7.9%

Asking Rate Low: $8.50

Asking Rate High: $11.12

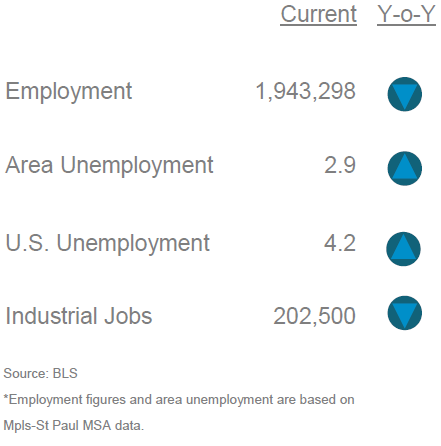

ECONOMIC OVERVIEW:

According to the Bureau of Labor Statistics (BLS), the unemployment rate for the Mpls-St Paul metropolitan statistical area (MSA) increased 100 basis points to 2.9% for November 2024 from 1.9% for November 2023. The unemployment rate for the US was at 4.2% in November 2024 increasing 50 basis points from last year. State of Minnesota unemployment rate was 3.5%. The Mpls-St Paul MSA saw an decrease in job growth while industrial specific jobs decreased in job growth in manufacturing by 2,800 during the same period.

MPLS-ST. PAUL AREA EMPLOYMENT STATS:

MARKET OVERVIEW:

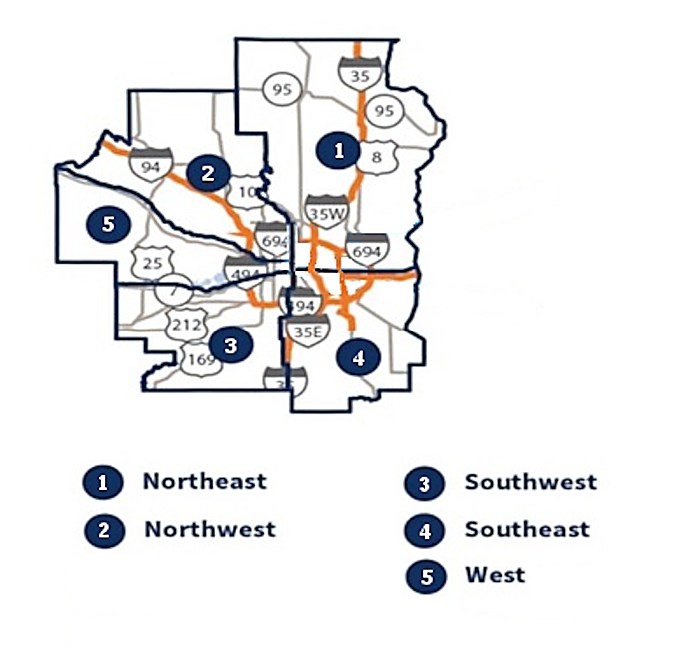

The Mpls-St Paul industrial market consists of 298.2 msf in eight counties across the metro. Overall, there was 1.3 msf of positive absorption for Q4 2024, bringing the YTD to 3.2 msf positive absorption. Multi-tenant only properties posted 351,400 sf positive absorption bringing the YTD to 113,300 sf positive absorption. The overall vacancy rate for the quarter was 5.2% and multi-tenant properties vacancy rate was 7.9%. To date, there are 27 construction projects throughout the market totaling 3.0 msf and 46 properties have been delivered this year with 4.9 msf.

MARKET HIGHLIGHTS:

The West market showed the lowest vacancy rate of 3.2% while the Southwest market is at the top with 6.9% for all properties. The Northwest bested all markets with 843,400 sf positive absorption led by NFI leasing 334,700 sf. The Southeast market was the only market to post negative absorption of (53,500) sf led by Dart vacating 80,400 sf. At the close of Q4 2024, the market experienced 3.4 msf of leasing activity in 167 transactions. One hundred five properties sold totaling 6.7 msf for $685.4 million.

MARKET MAP:

Q4 2024 Industrial Market Report is created by Minnesota Commercial Real Estate Association. For more information, you can reach them at: www.mncar.org

Market Insight

Get access to all future Industrial Market Reports below

Industrial Market Experts

News & Updates

Q1 2025 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Office Market SummaryFuture of Twin Cities Office Space: Smaller, Smarter, and Sustainable Forte’s Kate Damato, Senior Associate-Real Estate Advisory, provides insight to the Twin Cities office market report recently...

Q1 2025 Minneapolis-St. Paul Industrial Market Summary

MARKET INSIGHTQ1 2025 Minneapolis-St. Paul Industrial Market SummaryTwin Cities industrial market enters 2025 with sustained momentum in absorption and decreasing vacancy By: Erik Nordstrom, Senior Associate-Real Estate Advisory provides insight to the Twin Cities...

Q4 2024 Minneapolis-St. Paul Office Market Summary

MARKET INSIGHTQ4 2024 Minneapolis-St. Paul Office Market SummaryVacancy continues to rise as businesses prioritize high-quality space but less of it Forte’s Ericka Miller, Vice President-Real Estate Advisory, provides insight to the Twin Cities office market report...